Can RPA Save Banks 50% of Processing Time?

In today’s fast-paced banking landscape, efficiency and accuracy are crucial for financial institutions to remain competitive. Manual processing of repetitive tasks can be a significant bottleneck, wasting valuable time and resources. This is where Robotic Process Automation (RPA) comes in, promising to revolutionize the way banks operate.

RPA bots mimic human actions in applications, integrate with legacy systems, and run 24/7, freeing staff for high-value work, reducing errors, and accelerating customer service levels. But can RPA really save banks 50% of processing time? In this blog post, we’ll delve into the benefits of RPA in banking and explore the potential time-saving advantages.

The Problem with Manual Processing

Manual processing of tasks such as Know Your Customer (KYC) checks, report generation, and transaction reconciliation is a tedious and time-consuming process. Bank staff are often bogged down in repetitive tasks, taking away from more strategic and high-value work. This manual processing can lead to errors, delays, and increased costs.

For instance, a single KYC check can take up to 30 minutes to complete, and with thousands of customers to onboard daily, this can add up to a significant amount of time. Similarly, report generation and transaction reconciliation are time-consuming tasks that require manual data entry and verification.

The Solution: RPA Bots

RPA bots can automate these repetitive tasks, freeing up staff to focus on higher-value activities. RPA technology uses software robots to interact with applications, just like humans do, but with greater speed, accuracy, and consistency.

RPA bots can perform tasks such as:

- Data entry: Automating data entry and reduction of manual data entry errors.

- Document processing: Scanning, indexing, and extracting data from documents.

- Transaction processing: Automating transactions, such as payment processing and account reconciliation.

- Reporting: Generating reports and dashboards in real-time.

- Customer service: Handling customer inquiries and requests through chatbots and voice assistants.

Benefits of RPA in Banking

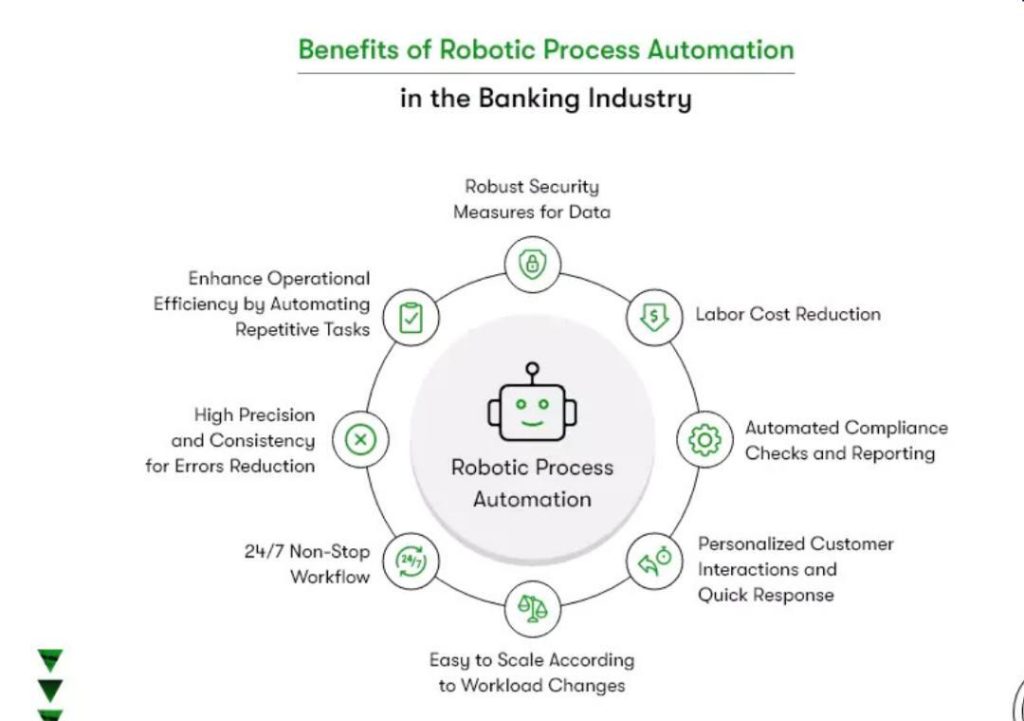

RPA has numerous benefits for banks, including:

- Increased Efficiency: RPA bots can automate repetitive tasks, freeing up staff to focus on higher-value activities.

- Improved Accuracy: RPA bots reduce errors by automating tasks and minimizing human intervention.

- Faster Processing Times: RPA bots can process transactions and reports in real-time, reducing processing times by up to 50%.

- Enhanced Customer Experience: RPA bots can provide 24/7 customer support, responding to customer inquiries and requests promptly.

- Cost Savings: RPA bots reduce labor costs by automating tasks and minimizing the need for manual intervention.

Case Studies: RPA in Banking

Several banks have already implemented RPA, achieving significant results. For example:

- A major US bank implemented RPA to automate its KYC checks, reducing processing time from 30 minutes to just 5 minutes.

- A European bank used RPA to automate its report generation, reducing report processing time from 2 hours to just 30 minutes.

- A leading Indian bank implemented RPA to automate its transaction reconciliation, reducing processing time from 3 days to just 1 hour.

Conclusion

RPA has the potential to revolutionize the way banks operate, automating repetitive tasks and freeing up staff to focus on higher-value activities. By automating tasks such as KYC checks, report generation, and transaction reconciliation, banks can reduce processing times by up to 50%. With its numerous benefits, RPA is an attractive solution for banks looking to improve efficiency, accuracy, and customer service levels.

Source:

https://www.growthjockey.com/blogs/robotic-process-automation-in-banking