US to impose tariffs on Chinese chip imports in 2027

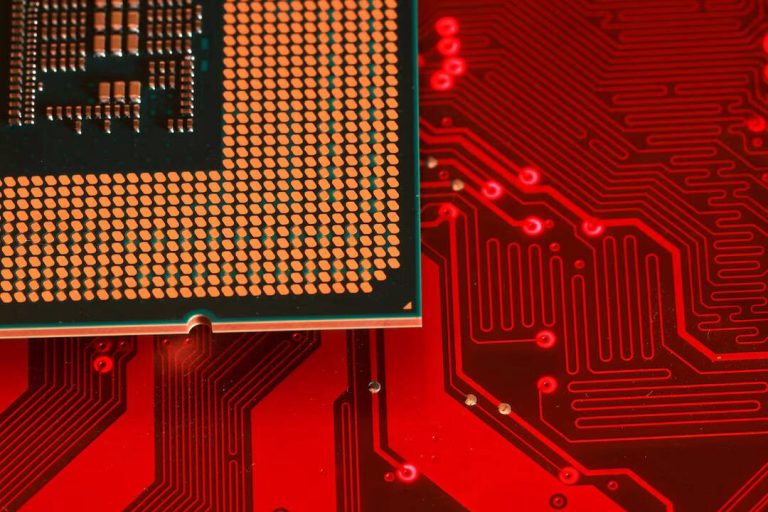

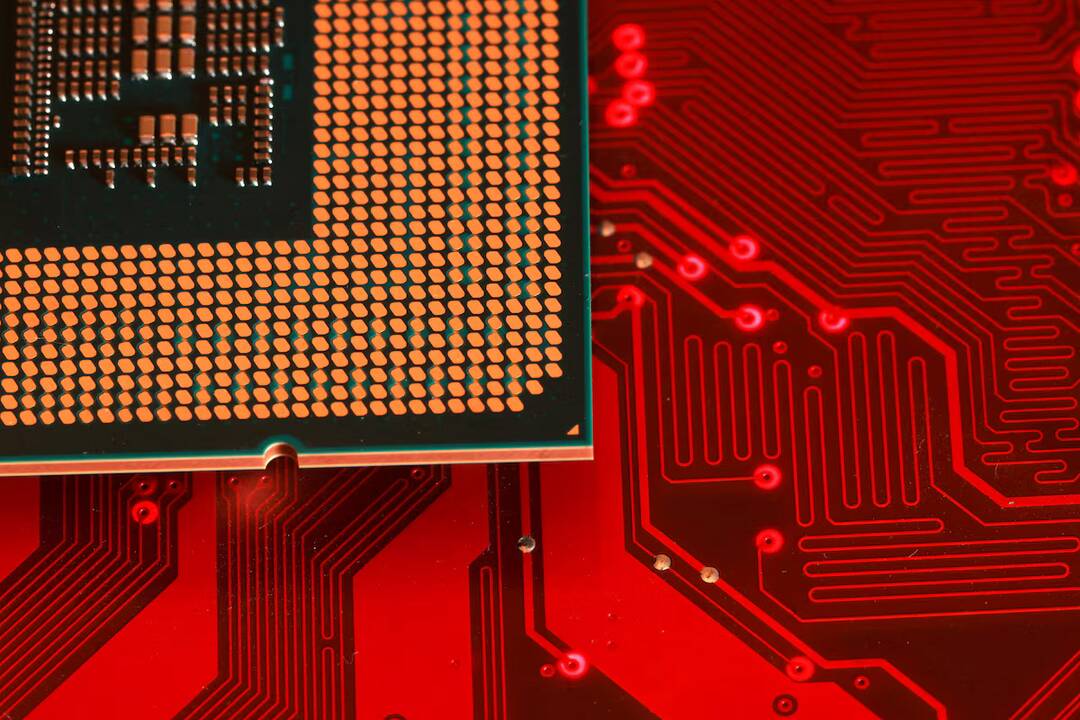

The United States has announced its decision to impose tariffs on Chinese semiconductor imports, a move that is expected to have significant implications for the global tech industry. According to a recent statement, the tariffs will come into effect in June 2027, marking a major development in the ongoing trade tensions between the two superpowers.

The decision to impose tariffs on Chinese chip imports is a result of the US government’s investigation into China’s practices in the semiconductor industry. The US Trade Representative has stated that “China’s targeting of the semiconductor industry for dominance is unreasonable and burdens or restricts US commerce and thus is actionable.” This suggests that the US government believes China’s actions in the semiconductor sector are unfair and detrimental to American businesses.

The tariffs are expected to affect a wide range of Chinese semiconductor products, including microchips, memory chips, and other related components. The US Trade Representative has announced that the tariff rate will be announced at least 30 days in advance, giving businesses and investors time to prepare for the changes.

The imposition of tariffs on Chinese chip imports is likely to have far-reaching consequences for the global tech industry. China is a major player in the semiconductor sector, with many Chinese companies, such as SMIC and Hua Hong Semiconductor, playing a crucial role in the global supply chain. The tariffs are expected to increase the cost of Chinese semiconductor products, making them less competitive in the global market.

The move is also likely to affect American companies that rely on Chinese semiconductor products, such as Apple, Qualcomm, and Intel. These companies may need to diversify their supply chains or find alternative sources for their semiconductor components, which could be a complex and costly process.

The decision to impose tariffs on Chinese chip imports is part of a broader effort by the US government to address trade imbalances and protect American industries. The US has been critical of China’s trade practices, including its use of subsidies, intellectual property theft, and forced technology transfer. The tariffs are seen as a way to level the playing field and ensure that American businesses are not unfairly disadvantaged by China’s actions.

The delay in imposing tariffs until June 2027 gives businesses and investors time to adjust to the new reality. However, it also creates uncertainty and unpredictability, which can be damaging to the global economy. The tariffs are likely to lead to higher prices, reduced demand, and decreased investment in the semiconductor sector, at least in the short term.

In the long term, the tariffs may lead to a shift in the global semiconductor industry, with companies looking to diversify their supply chains and reduce their reliance on Chinese products. This could lead to increased investment in semiconductor manufacturing in other countries, such as the US, South Korea, and Taiwan.

The imposition of tariffs on Chinese chip imports is a significant development in the ongoing trade tensions between the US and China. It reflects the US government’s commitment to protecting American industries and addressing trade imbalances. However, it also creates uncertainty and unpredictability, which can be damaging to the global economy.

As the situation continues to evolve, it will be important to monitor the impact of the tariffs on the global tech industry. The effects of the tariffs will be far-reaching, and it will be crucial for businesses and investors to stay informed and adapt to the changing landscape.

In conclusion, the US decision to impose tariffs on Chinese chip imports in 2027 is a significant development in the global tech industry. The move is expected to have far-reaching consequences, including increased costs, reduced demand, and decreased investment in the semiconductor sector. As the situation continues to evolve, it will be important to monitor the impact of the tariffs and stay informed about the latest developments.

The US Trade Representative’s decision to impose tariffs on Chinese chip imports is a result of a thorough investigation into China’s practices in the semiconductor industry. The investigation found that China’s actions in the sector are unfair and detrimental to American businesses. The tariffs are expected to level the playing field and ensure that American companies are not unfairly disadvantaged by China’s actions.

The delay in imposing tariffs until June 2027 gives businesses and investors time to adjust to the new reality. However, it also creates uncertainty and unpredictability, which can be damaging to the global economy. The tariffs are likely to lead to higher prices, reduced demand, and decreased investment in the semiconductor sector, at least in the short term.

As the global tech industry continues to evolve, it will be important to monitor the impact of the tariffs and stay informed about the latest developments. The imposition of tariffs on Chinese chip imports is a significant development, and it will be crucial for businesses and investors to adapt to the changing landscape.

Source: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/