Trump Imposes 25% Tariff on Imports of Some Advanced AI Chips

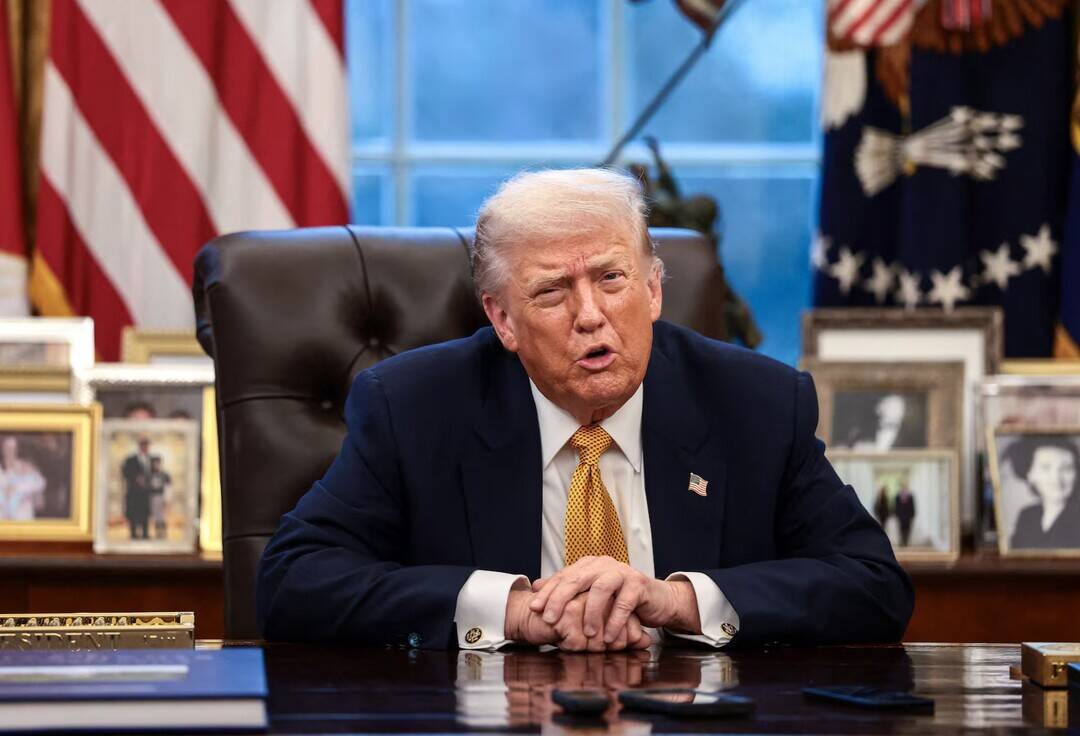

In a move that is expected to have significant implications for the tech industry, US President Donald Trump on Wednesday imposed a 25% tariff on certain advanced AI chips, including the NVIDIA H200 and AMD MI325X. The decision, which was announced by the White House, cited economic and national security risks arising from insufficient domestic production as the reason for the tariff.

The tariff, which will apply to imports of advanced computing chips used in a range of applications, including artificial intelligence, machine learning, and data analytics, is aimed at encouraging domestic production of these critical components. The White House stated that the move is necessary to address the economic and national security risks posed by the country’s reliance on foreign suppliers for these advanced chips.

The NVIDIA H200 and AMD MI325X, which are among the affected chips, are high-performance computing chips used in a range of applications, including data centers, cloud computing, and artificial intelligence. These chips are critical components in the development and deployment of AI and machine learning models, and are used by a range of companies, including tech giants such as Google, Amazon, and Facebook.

The imposition of the tariff is expected to have significant implications for the tech industry, which has become increasingly reliant on imports of advanced computing chips. The tariff is likely to increase the cost of these chips, which could have a ripple effect throughout the industry, impacting the development and deployment of AI and machine learning models.

However, the White House has stated that chips imported to support the buildout of the US technology supply chain will not be affected by the tariff. This move is aimed at encouraging domestic production of these critical components, while also ensuring that the US tech industry has access to the advanced chips it needs to remain competitive.

The decision to impose the tariff has been welcomed by some industry experts, who argue that it is necessary to address the economic and national security risks posed by the country’s reliance on foreign suppliers. “The US has become too reliant on foreign suppliers for critical components, including advanced computing chips,” said one industry expert. “This tariff is a necessary step to encourage domestic production and reduce our reliance on foreign suppliers.”

However, others have expressed concerns about the potential impact of the tariff on the tech industry. “The imposition of the tariff will increase the cost of advanced computing chips, which could have a significant impact on the development and deployment of AI and machine learning models,” said another industry expert. “This could also have a negative impact on the competitiveness of US tech companies, which rely on these chips to remain competitive.”

The tariff is also likely to have significant implications for the global trade landscape. The US has been engaged in a series of trade disputes with other countries, including China, over issues such as tariffs and intellectual property protection. The imposition of the tariff on advanced computing chips is likely to escalate these tensions, and could lead to retaliatory measures from other countries.

In conclusion, the imposition of the 25% tariff on imports of some advanced AI chips is a significant move that is expected to have far-reaching implications for the tech industry. While the decision is aimed at encouraging domestic production and reducing the country’s reliance on foreign suppliers, it is also likely to increase the cost of these critical components and have a negative impact on the competitiveness of US tech companies.

As the tech industry continues to evolve and become increasingly reliant on advanced computing chips, it is essential that the US takes steps to ensure that it has a stable and secure supply of these critical components. The imposition of the tariff is a step in this direction, but it is also important to consider the potential impact on the industry and the global trade landscape.