Trump Imposes 25% Tariff on Imports of Some Advanced AI Chips

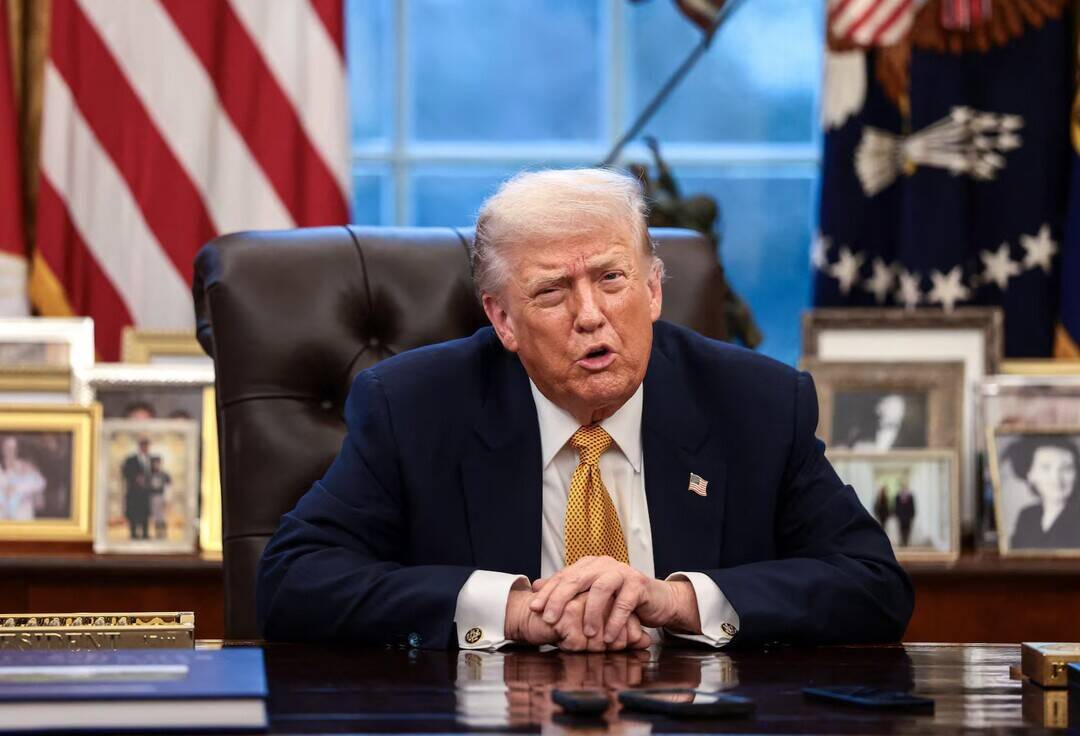

In a move that is set to have significant implications for the technology industry, US President Donald Trump on Wednesday announced the imposition of a 25% tariff on certain advanced AI chips. The tariff, which will affect imports of chips such as the NVIDIA H200 and AMD MI325X, is aimed at addressing economic and national security risks arising from insufficient domestic production.

According to the White House, the tariff is intended to promote the development of a domestic supply chain for advanced computing chips, which are critical components in a wide range of technologies, including artificial intelligence, 5G networks, and autonomous vehicles. The administration has argued that the current reliance on foreign suppliers, particularly from countries such as China and Taiwan, poses a risk to national security and economic stability.

The tariff will apply to imports of advanced AI chips that are used in a variety of applications, including data centers, cloud computing, and edge computing. However, chips imported to support the buildout of the US technology supply chain will be exempt from the tariff, the White House said. This exemption is intended to ensure that US companies are able to access the components they need to develop and manufacture advanced technologies, while also promoting the growth of a domestic supply chain.

The imposition of the tariff has been welcomed by some industry groups, which argue that it will help to level the playing field for US companies and promote the development of a domestic supply chain. However, others have expressed concerns that the tariff will lead to increased costs and reduced competitiveness for US companies, particularly those that rely heavily on imports of advanced AI chips.

The NVIDIA H200 and AMD MI325X chips, which are among the products affected by the tariff, are high-end chips that are used in a variety of applications, including data centers, cloud computing, and edge computing. They are also used in a range of emerging technologies, including artificial intelligence, machine learning, and autonomous vehicles.

The tariff is set to have significant implications for the technology industry, particularly for companies that rely heavily on imports of advanced AI chips. It is also likely to have implications for consumers, who may face higher prices for products that rely on these chips.

In recent years, the US has been seeking to reduce its reliance on foreign suppliers of critical components, particularly from countries such as China. The imposition of the tariff is part of a broader effort to promote the development of a domestic supply chain for advanced technologies, and to reduce the risks associated with foreign dependence.

The move is also seen as a way to promote the growth of the US technology industry, which is a critical sector of the economy. The technology industry is a significant contributor to US GDP, and is also a major source of employment and innovation.

However, the imposition of the tariff has also raised concerns about the potential impact on the global economy. Some analysts have warned that the tariff could lead to a trade war, particularly if other countries retaliate with their own tariffs on US exports.

The US has been seeking to reduce its trade deficit with countries such as China, and has imposed tariffs on a range of products, including steel, aluminum, and solar panels. The imposition of the tariff on advanced AI chips is seen as a further step in this effort, and is likely to have significant implications for the global trade landscape.

In conclusion, the imposition of a 25% tariff on imports of certain advanced AI chips is a significant move that is set to have far-reaching implications for the technology industry. While the tariff is intended to promote the development of a domestic supply chain and reduce the risks associated with foreign dependence, it is also likely to have significant implications for US companies and consumers. As the global trade landscape continues to evolve, it will be important to monitor the impact of this tariff and other trade policies on the technology industry and the broader economy.