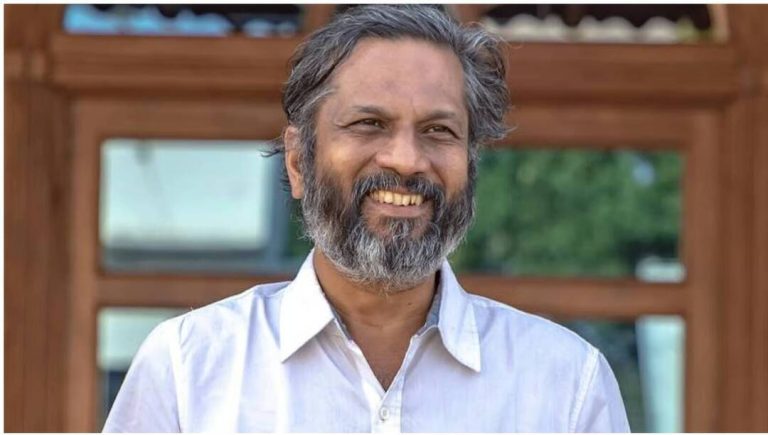

Owen Gunden, one of Bitcoin’s earliest & richest holders, sells entire $1.3 billion stake

The world of cryptocurrency has been abuzz with the news that Owen Gunden, one of Bitcoin’s earliest and richest holders, has sold his entire $1.3 billion stake in the cryptocurrency. According to multiple reports, Gunden has been liquidating his 11,000 BTC holding since October, with his final sale being the transfer of 2,499 BTC to US-based cryptocurrency exchange Kraken, as per Arkham Intelligence.

Gunden’s journey with Bitcoin began when the cryptocurrency was still in its infancy, and he reportedly bought Bitcoin when it was worth $1. This early investment has paid off handsomely, with his stake growing to a staggering $1.3 billion. However, it appears that Gunden has now decided to cash out, leaving many in the cryptocurrency community wondering what this means for the future of Bitcoin.

To understand the significance of Gunden’s sale, it’s essential to look at the history of Bitcoin and its evolution over the years. Bitcoin was created in 2009 by an individual or group of individuals using the pseudonym Satoshi Nakamoto. Initially, the cryptocurrency was met with skepticism, and its value was negligible. However, as more people began to take notice of Bitcoin, its value started to rise, and it gained popularity as a decentralized alternative to traditional currencies.

Gunden’s decision to invest in Bitcoin when it was still in its early stages was a bold move, and it has paid off significantly. His stake of 11,000 BTC was one of the largest individual holdings of Bitcoin, and its sale has sent shockwaves through the cryptocurrency market. The fact that Gunden has sold his entire stake has raised questions about the future of Bitcoin and whether this sale will have a significant impact on the cryptocurrency’s value.

One of the primary concerns is that Gunden’s sale could lead to a decrease in the value of Bitcoin. When a large holder like Gunden sells their stake, it can create a ripple effect in the market, leading to a decrease in demand and, subsequently, a decrease in value. However, it’s essential to note that the cryptocurrency market is highly volatile, and the value of Bitcoin can fluctuate rapidly.

Another factor to consider is the potential impact of Gunden’s sale on the cryptocurrency market as a whole. The sale of a large stake like Gunden’s can create a sense of uncertainty among investors, leading to a decrease in confidence in the market. This can have a ripple effect, impacting not just Bitcoin but other cryptocurrencies as well.

Despite these concerns, it’s essential to remember that the cryptocurrency market is highly resilient. Bitcoin has faced numerous challenges over the years, including regulatory hurdles, security concerns, and market volatility. However, the cryptocurrency has consistently demonstrated its ability to bounce back, and its value has continued to rise over the long term.

In addition to the potential impact on the cryptocurrency market, Gunden’s sale has also raised questions about the motivations behind his decision. It’s possible that Gunden has decided to cash out due to concerns about the future of Bitcoin or the cryptocurrency market as a whole. Alternatively, he may have simply decided that it’s time to realize his gains and move on to other investment opportunities.

Regardless of the motivations behind Gunden’s sale, one thing is clear: the cryptocurrency market will continue to evolve and adapt to changing circumstances. As more investors enter the market, and as the use of cryptocurrencies becomes more widespread, the value of Bitcoin and other cryptocurrencies is likely to continue to rise.

In conclusion, the news that Owen Gunden, one of Bitcoin’s earliest and richest holders, has sold his entire $1.3 billion stake in the cryptocurrency has sent shockwaves through the cryptocurrency community. While the sale has raised concerns about the potential impact on the value of Bitcoin and the cryptocurrency market as a whole, it’s essential to remember that the market is highly resilient and adaptable. As the cryptocurrency market continues to evolve, it will be interesting to see how Gunden’s sale affects the value of Bitcoin and the market as a whole.