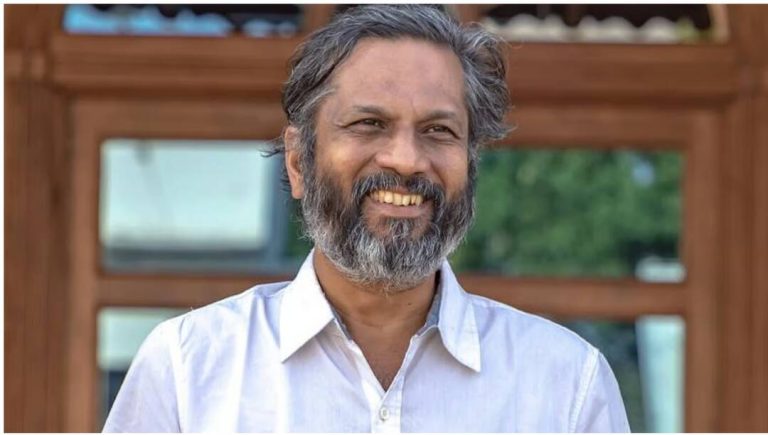

Owen Gunden, one of Bitcoin’s earliest & richest holders, sells entire $1.3 billion stake

The world of cryptocurrency has been abuzz with the news that Owen Gunden, one of Bitcoin’s earliest and richest holders, has sold his entire $1.3 billion stake in the digital currency. According to multiple reports, Gunden has been liquidating his massive 11,000 BTC holding since October, with his final sale being the transfer of 2,499 BTC to US-based cryptocurrency exchange Kraken, as per Arkham Intelligence.

This news has sent shockwaves through the cryptocurrency community, with many investors and enthusiasts wondering what prompted Gunden to sell off his entire stake. To understand the significance of this move, let’s take a closer look at Gunden’s history with Bitcoin and the circumstances surrounding his sale.

Gunden reportedly bought Bitcoin when it was worth just $1, a staggering bargain considering the cryptocurrency’s current value. Over the years, he accumulated a massive holding of 11,000 BTC, which, at its peak, was worth a staggering $1.3 billion. This made him one of the richest Bitcoin holders in the world, with a stake that rivaled that of the cryptocurrency’s founders.

So, why did Gunden decide to sell off his entire stake? While the exact reasons behind his decision are not clear, it’s likely that he decided to cash out his investment to realize the massive gains he had made over the years. With Bitcoin’s value having fluctuated wildly in recent years, Gunden may have decided that it was time to take his profits and avoid any potential losses.

The sale of Gunden’s Bitcoin stake has also sparked concerns about the potential impact on the cryptocurrency’s price. With such a large amount of BTC being sold off, there is a risk that the market could become flooded, leading to a decline in the cryptocurrency’s value. However, it’s worth noting that the sale of Gunden’s stake has been gradual, with the final sale being the transfer of 2,499 BTC to Kraken.

Despite the potential risks, many investors and enthusiasts remain bullish on Bitcoin’s long-term prospects. The cryptocurrency has come a long way since its inception, with its value increasing exponentially over the years. While there have been fluctuations in the market, many experts believe that Bitcoin has the potential to continue growing in value, driven by increasing adoption and demand.

In addition to its potential for growth, Bitcoin has also become an increasingly mainstream investment option. Many institutional investors, including hedge funds and pension funds, have begun to take notice of the cryptocurrency, with some even investing in it as a way to diversify their portfolios. This increased interest has helped to drive up demand for Bitcoin, which in turn has helped to drive up its value.

As the news of Gunden’s sale continues to make headlines, many are left wondering what the future holds for Bitcoin. While the sale of his stake may have sparked concerns about the potential impact on the cryptocurrency’s price, it’s worth noting that the market has so far remained resilient. With many investors and enthusiasts remaining bullish on Bitcoin’s long-term prospects, it’s likely that the cryptocurrency will continue to grow in value over time.

In conclusion, the sale of Owen Gunden’s $1.3 billion Bitcoin stake is a significant development in the world of cryptocurrency. While the reasons behind his decision to sell off his entire stake are not clear, it’s likely that he decided to cash out his investment to realize the massive gains he had made over the years. As the market continues to evolve, it will be interesting to see how the sale of Gunden’s stake affects the price of Bitcoin and the broader cryptocurrency market.

For now, one thing is clear: the world of cryptocurrency is constantly evolving, with new developments and news emerging every day. Whether you’re a seasoned investor or just starting to learn about Bitcoin and other digital currencies, it’s essential to stay informed and up-to-date on the latest news and trends.