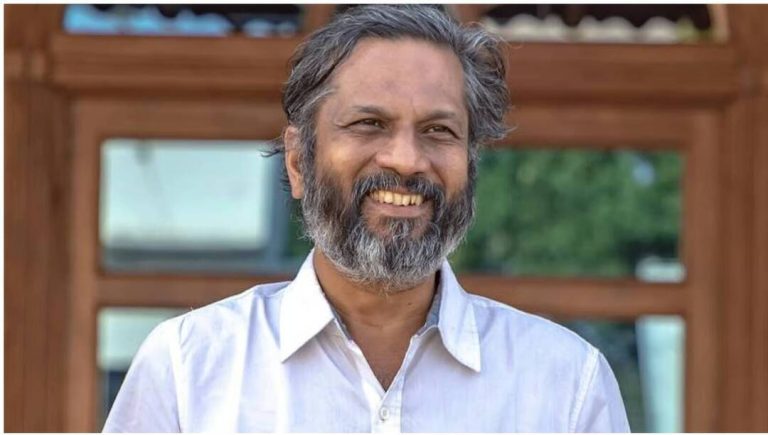

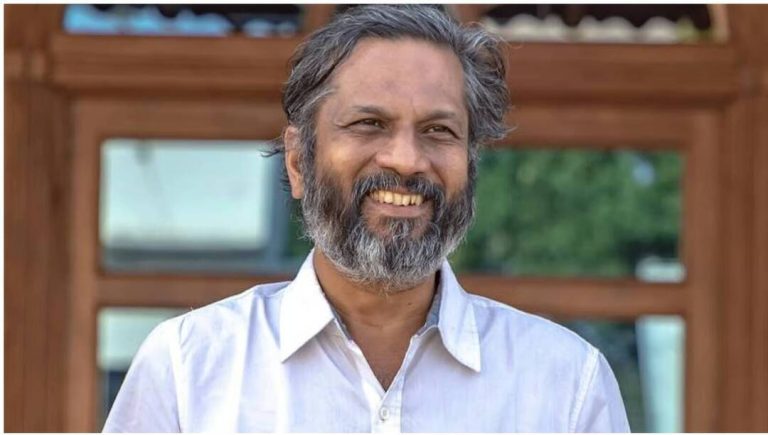

Owen Gunden, one of Bitcoin’s earliest & richest holders, sells entire $1.3 billion stake

The world of cryptocurrency has been abuzz with the news of Owen Gunden, one of Bitcoin’s earliest and richest holders, selling his entire $1.3 billion stake in the cryptocurrency. According to multiple reports, Gunden has been liquidating his 11,000 BTC holding since October, with his final sale being the transfer of 2,499 BTC to US-based cryptocurrency exchange Kraken, as per Arkham Intelligence. This move has sent shockwaves through the cryptocurrency community, leaving many to wonder what prompted Gunden to sell off his massive stake.

Gunden, a prominent figure in the Bitcoin community, reportedly bought Bitcoin when it was worth just $1. At the time, many were skeptical about the potential of the cryptocurrency, but Gunden saw its potential and invested heavily. Over the years, he watched as the value of Bitcoin skyrocketed, making him one of the richest holders of the cryptocurrency. His 11,000 BTC holding was valued at a staggering $1.3 billion, making him one of the most successful investors in the space.

So, why did Gunden decide to sell off his entire stake? The reasons behind this move are still unclear, but there are several theories. One possibility is that Gunden may have decided to cash out his investment in order to diversify his portfolio or to invest in other opportunities. With the value of Bitcoin having increased exponentially over the years, it’s possible that Gunden may have decided to take his profits and explore other investment options.

Another theory is that Gunden may have been concerned about the regulatory environment surrounding cryptocurrencies. In recent years, there has been increasing scrutiny of cryptocurrencies from governments and regulatory bodies around the world. This has led to a degree of uncertainty and volatility in the market, which may have prompted Gunden to sell off his stake.

Gunden’s decision to sell off his entire stake has also raised questions about the potential impact on the market. With one of the largest holders of Bitcoin selling off their stake, there is a risk that the price of the cryptocurrency could be affected. However, it’s worth noting that the sale of Gunden’s stake was reportedly made over a period of time, with the final sale being the transfer of 2,499 BTC to Kraken. This suggests that the sale was made in a way that was designed to minimize the impact on the market.

The sale of Gunden’s stake also highlights the ongoing debate about the role of large holders in the cryptocurrency market. Some have argued that large holders, such as Gunden, have too much influence over the market and can manipulate the price of Bitcoin. Others have argued that large holders are essential to the stability of the market, providing liquidity and helping to drive adoption.

Regardless of the reasons behind Gunden’s decision to sell off his stake, one thing is clear: the sale of his $1.3 billion stake is a significant event in the world of cryptocurrency. It highlights the ongoing volatility and uncertainty of the market, as well as the potential risks and rewards of investing in cryptocurrencies.

As the cryptocurrency market continues to evolve and mature, it will be interesting to see how the sale of Gunden’s stake affects the market. Will it lead to a decline in the price of Bitcoin, or will it have a minimal impact? Only time will tell.

In conclusion, the sale of Owen Gunden’s $1.3 billion stake in Bitcoin is a significant event that has sent shockwaves through the cryptocurrency community. While the reasons behind the sale are still unclear, it highlights the ongoing uncertainty and volatility of the market. As the market continues to evolve, it will be interesting to see how the sale of Gunden’s stake affects the price of Bitcoin and the wider cryptocurrency market.