Govt issues warning about ‘PAN 2.0’ card scam alert

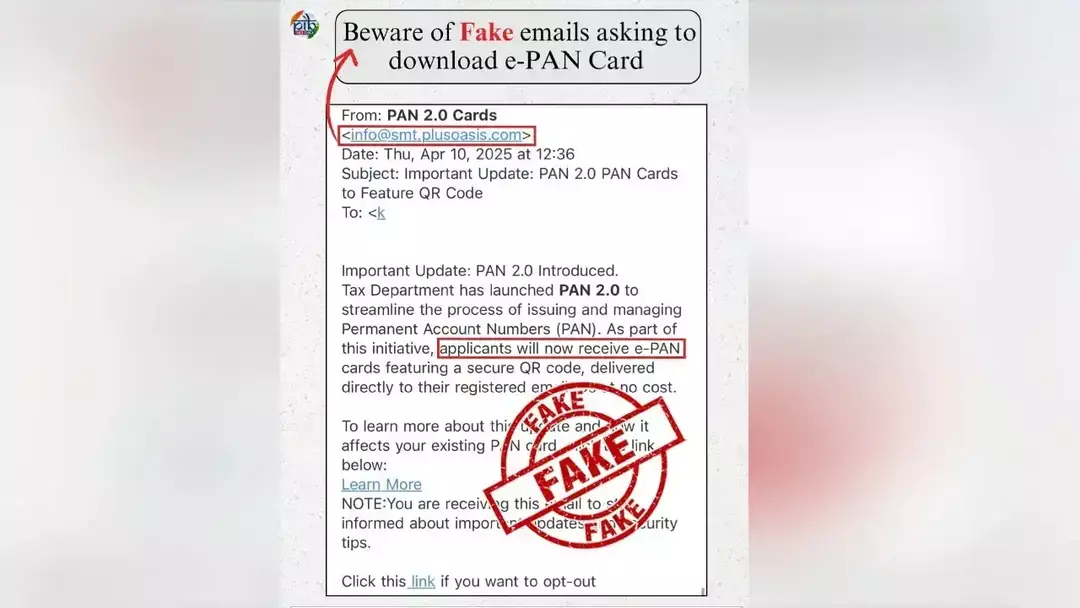

In a recent alert, the government has warned taxpayers about a widespread phishing campaign that falsely claims to offer upgraded “PAN 2.0” cards. The phishing emails, which are being sent to individuals, claim that a new PAN card version with QR code support is available and prompt recipients to click a link to download their free “e-PAN”.

According to PIB Fact Check, the deceptive emails are being sent to taxpayers, attempting to trick them into revealing their personal and financial details. The government has issued a warning to taxpayers to be cautious of these emails and not to fall prey to this scam.

For those who may not be aware, PAN (Permanent Account Number) is a unique 10-digit alphanumeric number issued by the Income Tax Department of India to taxpayers. It is used to track financial transactions and is required for filing income tax returns.

The phishing emails being sent to taxpayers claim that the “PAN 2.0” card is an upgraded version of the existing PAN card, which comes with a QR code that can be used for various financial transactions. The email may seem convincing, as it may include official-looking logos and language, but it is actually a scam designed to trick taxpayers into revealing their sensitive information.

The scammers may try to persuade taxpayers to click on the link provided in the email to download their free “e-PAN”, which is actually a malware-laden link designed to compromise the taxpayer’s device and steal their personal and financial information.

The government has warned taxpayers to be cautious of such emails and not to click on any links or download any attachments from unfamiliar sources. Taxpayers are advised to verify the authenticity of any email or message claiming to come from the Income Tax Department or any other government agency before taking any action.

So, what can taxpayers do to protect themselves from this scam?

-

Be cautious of unsolicited emails: If you receive an email claiming to offer an upgraded PAN card or any other government service, be cautious. Legitimate government agencies will not contact you via email or phone to request personal or financial information.

-

Verify the authenticity of the email: Before taking any action, verify the authenticity of the email. Check the sender’s email address and the content of the email. Legitimate government agencies will have a formal email address and will not use generic or vague language.

-

Do not click on suspicious links: Avoid clicking on any links or downloading attachments from unfamiliar sources. These links can be designed to compromise your device and steal your personal and financial information.

-

Use strong antivirus software: Install strong antivirus software and keep it updated to protect your device from malware and other online threats.

-

Report suspicious emails: If you receive a suspicious email claiming to come from the Income Tax Department or any other government agency, report it to the relevant authorities. You can also forward the email to the National Cyber Crime Reporting Portal (ncr.gov.in) or the Cyber Cell of your state.

The government has also advised taxpayers to use only official websites and channels to interact with the Income Tax Department. Taxpayers are advised to visit the official website of the Income Tax Department (www.incometaxindia.gov.in) to access any information or services related to their PAN card.

In conclusion, taxpayers must be cautious of phishing emails claiming to offer upgraded “PAN 2.0” cards or any other government services. The government has warned taxpayers to verify the authenticity of any email or message claiming to come from the Income Tax Department or any other government agency before taking any action. By following the tips provided above, taxpayers can protect themselves from this scam and ensure the security of their personal and financial information.