Consumer Recovery Strategies Driving Resilience

The ongoing economic uncertainty has brought about a significant shift in consumer behavior, with many individuals adopting a more cautious approach to their spending habits. In response, companies are implementing targeted recovery strategies to retain customers and foster long-term engagement. These strategies focus on providing value-driven communication, loyalty programs, and personalized offers to alleviate the financial strain experienced by consumers.

The importance of understanding consumer spending patterns cannot be overstated. Digital tools have revolutionized the way businesses gather insights into their customers’ behaviors, allowing them to tailor their recovery efforts with precision. By leveraging data analytics and machine learning algorithms, companies can identify patterns in consumer spending and develop targeted campaigns to re-engage with customers.

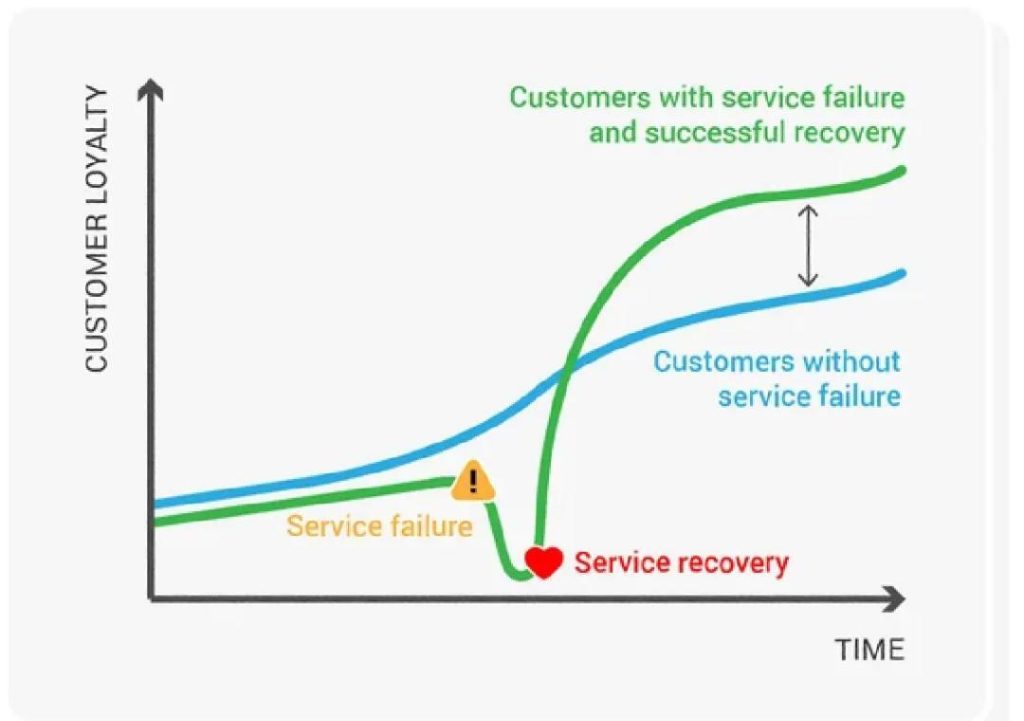

One of the key strategies being employed by companies is the implementation of loyalty programs. These programs reward customers for their continued loyalty, providing them with exclusive offers, discounts, and perks that incentivize repeat business. By fostering a sense of belonging and appreciation, loyalty programs help to build strong relationships between customers and businesses, ultimately driving retention and long-term growth.

Another effective strategy is the use of value-driven communication. As consumers become increasingly discerning about their spending habits, businesses must communicate the value proposition of their products or services in a clear and compelling manner. This can be achieved through personalized emails, targeted ads, and social media campaigns that emphasize the benefits and unique selling points of a brand’s offerings.

The importance of customer-centric approaches cannot be overstated. By putting the customer at the forefront of their recovery efforts, businesses can build trust, loyalty, and advocacy. This is achieved through a combination of excellent customer service, personalized interactions, and a deep understanding of customer needs and preferences.

In addition to these strategies, companies are also leveraging digital tools to streamline their recovery efforts. Automation software, for example, allows businesses to quickly and efficiently respond to customer inquiries, resolve issues, and provide personalized support. This not only improves the overall customer experience but also helps to reduce costs and increase operational efficiency.

The use of AI-powered chatbots is another digital tool being employed by companies to drive recovery. These chatbots can be programmed to provide 24/7 support, answering common customer questions and resolving simple issues without the need for human intervention. This not only improves the customer experience but also helps to reduce the workload of customer support teams, allowing them to focus on more complex issues and high-value tasks.

The role of data and analytics in consumer recovery cannot be overstated. By leveraging data insights, businesses can gain a deeper understanding of their customers’ behaviors, preferences, and pain points. This information can be used to develop targeted campaigns, improve customer experiences, and drive retention and growth.

In conclusion, the recovery strategies being employed by companies are driving resilience and long-term engagement amid changing economic conditions. By leveraging digital tools, customer-centric approaches, and value-driven communication, businesses can build strong relationships with their customers, retain loyalty, and drive growth. As the economic landscape continues to evolve, the importance of these strategies will only continue to grow, providing a vital lifeline for businesses looking to navigate the challenges ahead.

Source: https://www.growthjockey.com/blogs/evolution-in-consumer-recovery