Fake Startup Tricks 27 VCs, Sparks Big Questions

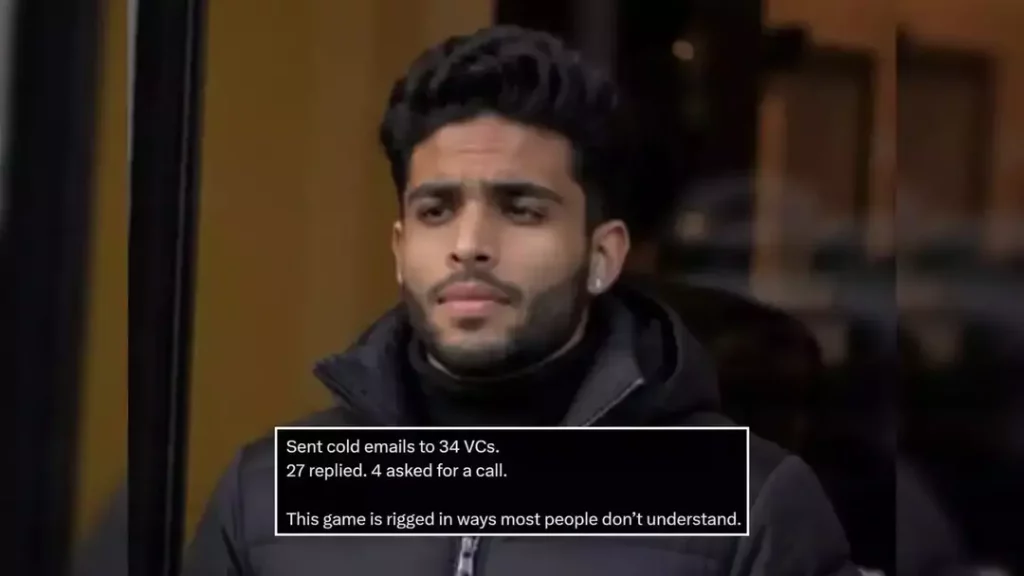

In a shocking revelation, a UC Berkeley graduate, Bhavye Khetan, has demonstrated how easily venture capitalists can be swayed by superficial buzzwords and hype. Khetan created a fake AI-Web3 startup, complete with jargon-filled pitches and fake team members, and miraculously managed to interest 27 investors. This stunt raises serious concerns about the due diligence process in startup evaluations and highlights the need for greater transparency in the venture capital industry.

Khetan’s experiment, which he documented on his blog, involved creating a fictional startup called “Nebula”, which promised to revolutionize the AI and Web3 industries with its “novel approach to decentralized machine learning”. The startup’s pitch deck, complete with elaborate graphics and technical jargon, was designed to appeal to the interests of venture capitalists.

What’s astonishing is that despite having no real product, team, or office, Khetan managed to convince 27 investors to show interest in Nebula. The investors, who were not named, were reportedly impressed by the startup’s “ambitious goals” and “visionary leadership”. Khetan’s blog post provides a detailed account of his experiment, including the emails and meeting requests he received from investors.

So, what went wrong? Why did so many venture capitalists fall for the fake startup’s pitch? The answer lies in the ease with which buzzwords can sway funding decisions. In today’s startup landscape, terms like “AI”, “Web3”, and “decentralized” are often used to create a sense of excitement and innovation. Khetan’s experiment shows that investors are more likely to be swayed by these buzzwords than by a startup’s actual product or team.

This raises serious concerns about the due diligence process in startup evaluations. Venture capitalists are responsible for ensuring that the startups they invest in have a solid foundation, including a viable product, a talented team, and a clear business plan. However, Khetan’s experiment suggests that many investors are failing to perform adequate due diligence, opting instead to rely on superficial buzzwords and hype.

The consequences of this lack of due diligence can be severe. Investors may end up pouring their money into startups that are not viable, leading to financial losses and wasted resources. Furthermore, this lack of accountability can undermine the entire startup ecosystem, making it difficult for entrepreneurs to secure funding and for investors to make informed decisions.

So, what can be done to address these issues? First and foremost, venture capitalists need to rethink their due diligence process. Rather than relying on superficial buzzwords and hype, investors should focus on evaluating a startup’s actual product, team, and business plan. This may involve more time-consuming and resource-intensive efforts, but it is essential for ensuring that investments are made wisely.

Secondly, there is a need for greater transparency in startup evaluations. Investors should be more open about their decision-making processes and the criteria they use to evaluate startups. This will help to build trust and accountability within the startup ecosystem.

Finally, entrepreneurs and investors alike need to be more discerning when it comes to evaluating startups. Rather than getting caught up in the hype surrounding buzzwords like “AI” and “Web3”, investors should focus on the substance behind a startup’s pitch. This may involve asking tough questions and demanding concrete evidence of a startup’s viability.

In conclusion, Bhavye Khetan’s fake startup experiment has sparked big questions about the venture capital industry. The ease with which 27 investors were swayed by superficial buzzwords and hype is a sobering reminder of the need for greater transparency and accountability in startup evaluations. By rethinking their due diligence process and focusing on the substance behind a startup’s pitch, investors can help to build a more sustainable and responsible startup ecosystem.