Premium Yours, Benefits for Adani: Rahul on LIC’s ₹5,000 Crore Investment in Adani

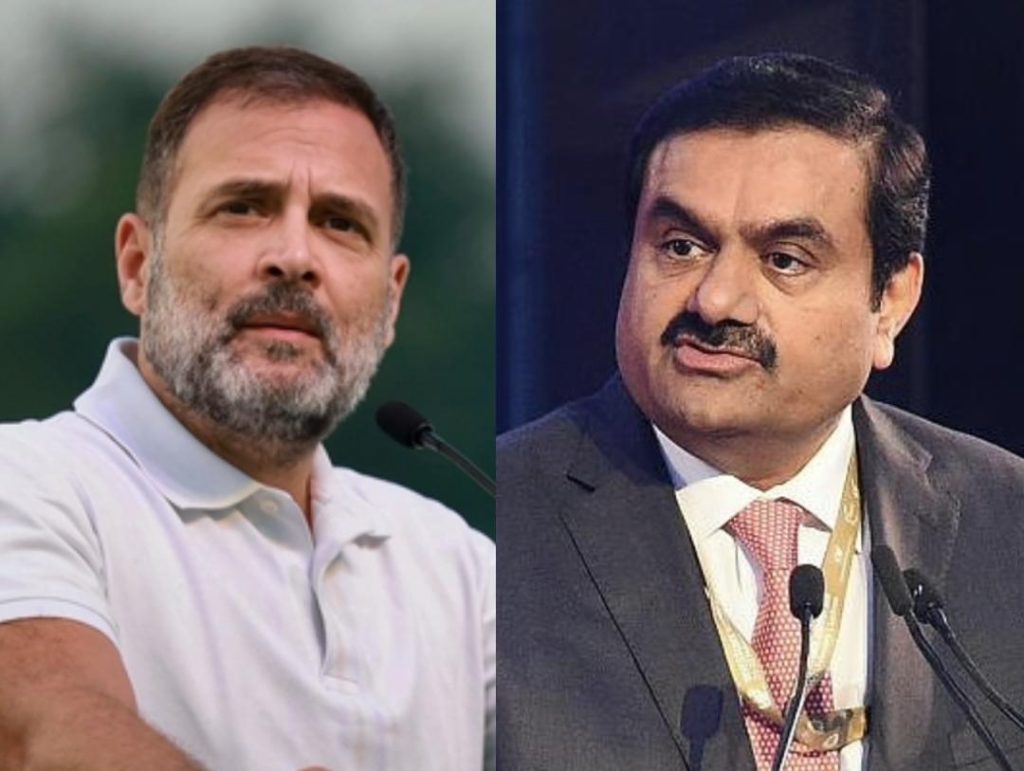

In a scathing attack on the government’s handling of the country’s financial institutions, Lok Sabha Leader of Opposition Rahul Gandhi has raised serious concerns over Life Insurance Corporation’s (LIC) massive ₹5,000 crore investment in Adani Ports. The development comes after a Bloomberg report claimed that LIC is the sole buyer in Adani Ports’ record bond sale. Adani Ports had later confirmed securing a ₹5,000 crore domestic bond, fully subscribed by LIC.

Gandhi’s remarks, made during a press conference, were laced with sarcasm and innuendo. He stated, “The money, the policy, the premium are yours. Security, convenience, and benefits are for Adani.” This comment is a clear indication that Gandhi believes LIC’s massive investment in Adani Ports is a clear case of the government’s crony capitalism, where the ruling party is using its influence to benefit its corporate friends at the expense of the public.

The ₹5,000 crore bond sale is indeed a significant development, considering it is the largest-ever domestic bond sale in the country. The fact that LIC, a state-owned insurance company, is the sole buyer of this bond is also noteworthy. This raises several questions about the government’s role in facilitating this transaction and whether LIC was forced to participate in this bond sale against its will.

The opposition has long been critical of the government’s handling of LIC, accusing it of using the insurance company as a tool to prop up its corporate cronies. This latest development only adds fuel to the fire, as it appears that LIC’s funds are being used to benefit private companies like Adani Ports.

Gandhi’s comments have been echoed by other opposition leaders, who have also questioned the government’s motives behind this transaction. “This is a clear case of crony capitalism,” said Congress leader Jairam Ramesh. “LIC is a public institution, and its funds should be used to benefit the public, not private companies like Adani Ports.”

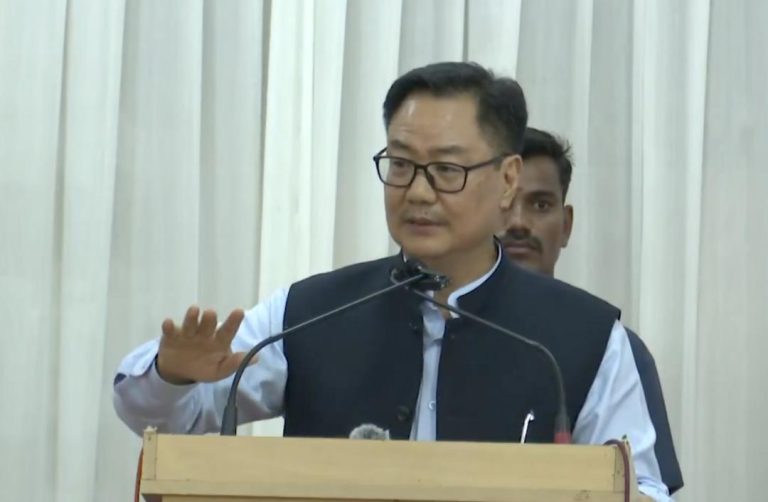

The government, however, has defended the transaction, stating that it is a normal business deal between two private companies. “LIC is a professional organization, and it makes its own investment decisions,” said a government spokesperson. “The bond sale was a commercial transaction, and it is not unusual for companies to raise funds through bond sales.”

While the government may claim that this is a normal business transaction, the fact remains that LIC is a state-owned institution that is supposed to be working for the benefit of the public. The opposition’s concerns about crony capitalism and the government’s favoritism towards private companies are therefore well-founded.

Moreover, this transaction raises serious questions about the regulation of financial institutions in the country. The Securities and Exchange Board of India (SEBI) is responsible for regulating the capital markets in India, but it appears that the regulator has failed to ensure that the bond sale was transparent and fair.

The opposition has called for a probe into the transaction, and has demanded that the government disclose all the details of the bond sale. “The government must come clean on this transaction and explain why LIC was forced to participate in this bond sale,” said Gandhi.

The controversy surrounding LIC’s ₹5,000 crore investment in Adani Ports is a clear indication that the government’s crony capitalism is not limited to just one or two instances. It is a widespread phenomenon that is being perpetuated by the government’s favoritism towards private companies.

In conclusion, Rahul Gandhi’s remarks about LIC’s ₹5,000 crore investment in Adani Ports are a timely warning about the dangers of crony capitalism. The government must take immediate action to address the concerns of the opposition and ensure that the country’s financial institutions are used for the benefit of the public, not private companies.

Source:

https://repository.inshorts.com/articles/en/PTI/132675f9-ee0a-4137-9c7f-6921b44c9ea0