Chandigarh Municipal Corporation Reveals Property Tax Defaulters

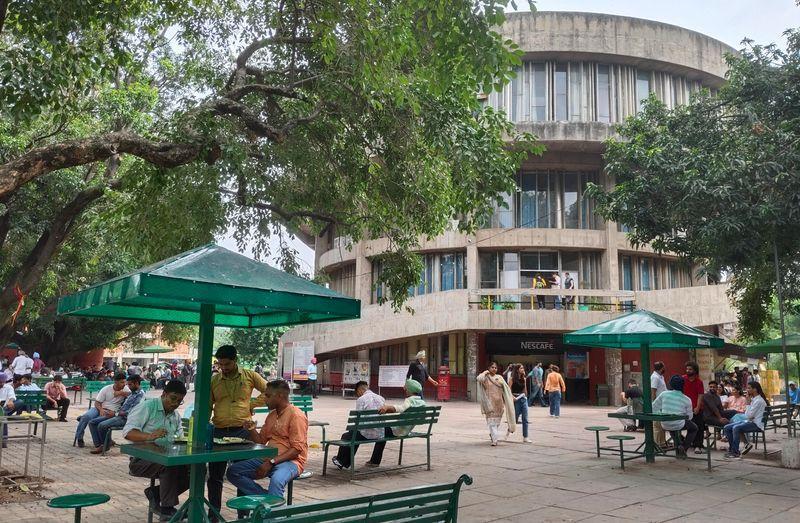

The Chandigarh Municipal Corporation (MC) has recently disclosed a list of top property tax defaulters in the city, sparking controversy and surprise among the residents. According to the information provided by the MC, Panjab University tops the list of defaulters, followed closely by IT Park Chandigarh and the Postgraduate Institute of Medical Education and Research (PGIMER).

This revelation came in response to a question raised by councillor Mahesh Inder Singh Sidhu during a meeting of the House. Sidhu had sought information on the top 10 property tax defaulters in the city, and the MC provided the list, which has left many questioning the tax collection policies of the corporation.

As per the list, Panjab University has a staggering outstanding property tax of over Rs 1.25 crore, making it the largest defaulter in the city. The IT Park Chandigarh, which is a major commercial hub, has an outstanding tax of over Rs 60 lakh, while the PGIMER has an outstanding tax of over Rs 45 lakh.

The list also includes other prominent institutions and establishments, such as the Chandigarh College of Engineering and Technology, the Government Medical College, and the Sector 17 Plaza. These institutions have outstanding property taxes ranging from Rs 20 lakh to Rs 40 lakh.

While the MC has claimed that it is taking steps to recover the outstanding taxes, the revelation has sparked concerns among residents about the effectiveness of the tax collection mechanism. Many are questioning why these prominent institutions and establishments are unable to pay their property taxes on time, and what measures are being taken to ensure that such defaulters are brought to book.

The MC has attributed the default to various reasons, including pending payment of previous years’ taxes, disputes over property valuation, and lack of timely submissions of documents. However, many residents are skeptical about these reasons and are demanding concrete action to be taken against the defaulters.

The revelation has also raised questions about the transparency of the tax collection process. Many residents have expressed concern that the MC is not doing enough to publicize the defaulters’ list, and that the information is only being shared with councillors and other select individuals.

The MC has defended its decision to provide the information to councillors, saying that it is a part of its transparency policy. However, many residents are demanding that the information be made public and that the MC take concrete steps to recover the outstanding taxes.

In recent years, the MC has faced criticism for its alleged corruption and inefficiency. The revelation of the property tax defaulters’ list has only added fuel to the fire, and many are demanding reforms in the tax collection mechanism.

In conclusion, the revelation of the property tax defaulters’ list by the Chandigarh Municipal Corporation has raised important questions about the transparency and effectiveness of the tax collection process. While the MC has attributed the default to various reasons, many residents are demanding concrete action to be taken against the defaulters and reforms in the tax collection mechanism.

Source: https://www.tribuneindia.com/news/chandigarh/panjab-varsity-tops-list-of-property-tax-defaulters/