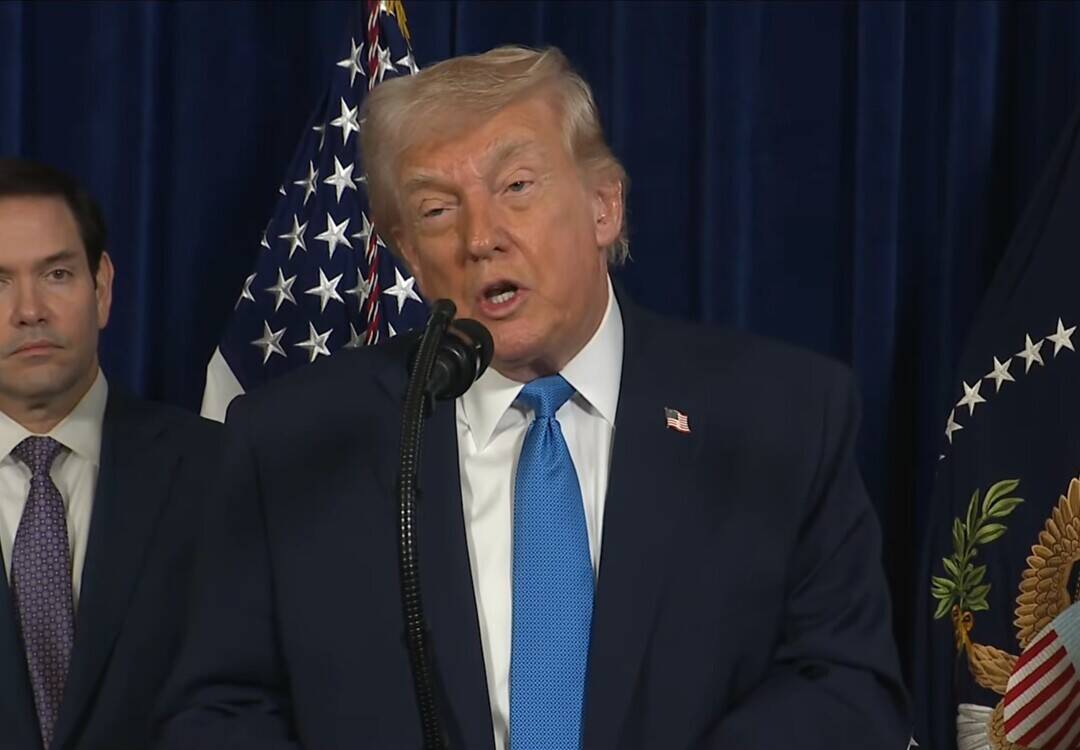

US companies will make money for the country now: Trump hours after Venezuela attack

In a recent statement, Donald Trump, the former President of the United States, claimed that Venezuela has cost the US “billions of dollars” by unilaterally seizing American oil and assets. Trump’s comments came just hours after a reported attack on Venezuelan soil, which has sparked a flurry of diplomatic activity and raised questions about the future of US-Venezuela relations.

According to Trump, the US built Venezuela’s oil industry with “American talent, drive, and skill,” only to have the socialist regime “steal it from us…through force.” This statement reflects a long-standing grievance among US policymakers and business leaders, who have watched as Venezuela’s state-owned oil company, Petróleos de Venezuela (PDVSA), has taken control of the country’s oil resources and excluded American companies from the market.

However, Trump’s statement also suggests that the US is poised to re-engage with Venezuela’s oil industry, albeit on its own terms. The former President claimed that US oil companies will spend “billions” to fix Venezuela’s “badly broken” oil infrastructure, which has suffered from years of neglect and mismanagement. This investment, Trump argued, will not only help to repair Venezuela’s oil industry but also “start making money for the country.”

The implications of Trump’s statement are significant, and could have far-reaching consequences for both the US and Venezuela. On the one hand, the entry of US oil companies into the Venezuelan market could provide a much-needed injection of capital and expertise, helping to reverse the decline of the country’s oil industry. This, in turn, could help to stabilize Venezuela’s economy and provide a boost to the country’s struggling citizens.

On the other hand, Trump’s comments have also raised concerns about the potential risks and challenges associated with US investment in Venezuela’s oil industry. The country’s socialist regime has a long history of expropriating foreign assets and excluding international companies from the market, which could make it difficult for US oil companies to operate effectively. Additionally, the reported attack on Venezuelan soil has raised questions about the security situation in the country, and the potential risks to US personnel and assets.

Despite these challenges, Trump’s statement suggests that the US is committed to re-engaging with Venezuela’s oil industry, and that US companies are eager to invest in the country’s energy sector. This could be a significant development, not only for the US and Venezuela but also for the global energy market as a whole. As the world’s demand for oil continues to grow, the entry of US companies into the Venezuelan market could help to increase global oil supplies and reduce prices.

However, the success of this effort will depend on a range of factors, including the ability of US companies to navigate Venezuela’s complex regulatory environment and the willingness of the socialist regime to cooperate with international investors. It will also require a significant investment of capital and expertise, as well as a long-term commitment to rebuilding and restoring Venezuela’s oil industry.

In the short term, Trump’s statement is likely to be seen as a positive development by US oil companies, which have been eager to invest in Venezuela’s energy sector for years. The prospect of repairing and restoring the country’s oil infrastructure, and of generating significant profits from the sale of Venezuelan oil, is likely to be highly attractive to these companies.

At the same time, however, Trump’s comments have also raised concerns about the potential risks and challenges associated with US investment in Venezuela. The country’s socialist regime has a long history of expropriating foreign assets and excluding international companies from the market, which could make it difficult for US oil companies to operate effectively. Additionally, the reported attack on Venezuelan soil has raised questions about the security situation in the country, and the potential risks to US personnel and assets.

Ultimately, the success of US investment in Venezuela’s oil industry will depend on a range of factors, including the ability of US companies to navigate the country’s complex regulatory environment and the willingness of the socialist regime to cooperate with international investors. It will also require a significant investment of capital and expertise, as well as a long-term commitment to rebuilding and restoring Venezuela’s oil industry.

As the situation continues to unfold, it will be important to watch for further developments and to assess the potential risks and benefits associated with US investment in Venezuela’s oil industry. For now, however, Trump’s statement suggests that the US is committed to re-engaging with Venezuela’s energy sector, and that US companies are eager to invest in the country’s oil industry.

News Source: https://www.youtube.com/watch