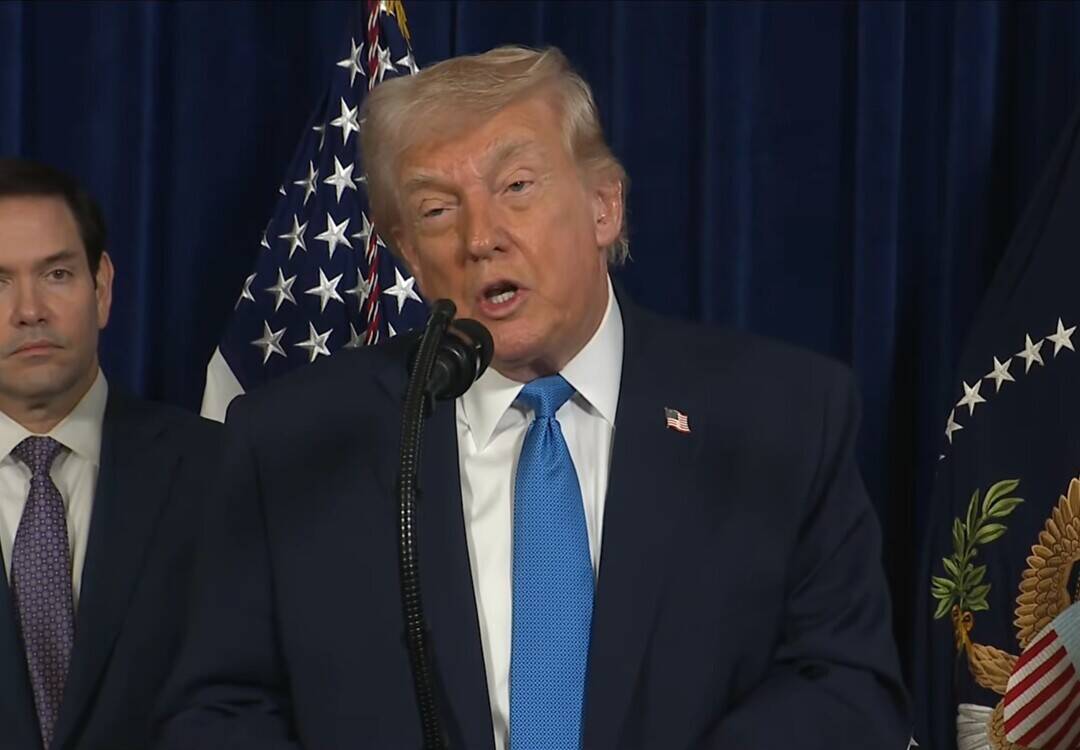

US companies will make money for the country now: Trump hours after Venezuela attack

In a recent statement, Donald Trump, the former President of the United States, made a bold claim regarding the economic relationship between the US and Venezuela. Trump stated that Venezuela has cost the US “billions of dollars” by unilaterally seizing American oil and assets. This move, according to Trump, was a blatant display of the socialist regime’s disregard for American interests and investments.

“We built Venezuela’s oil industry with American talent, drive and skill, and the socialist regime stole it from us…through force,” Trump said, emphasizing the significant role that American companies and expertise played in developing Venezuela’s oil industry. The seizure of these assets, Trump argued, was a clear violation of international norms and a significant loss for the US economy.

However, Trump’s statement did not stop at criticizing Venezuela’s actions. He also outlined a plan for US companies to invest in and rebuild Venezuela’s oil infrastructure, which he described as “badly broken.” According to Trump, this investment would not only benefit Venezuela but also generate significant profits for US companies, ultimately “making money for the country.”

The idea that US companies will spend billions to fix Venezuela’s oil infrastructure and start generating revenue is an intriguing one. On one hand, it is true that Venezuela’s oil industry is in dire need of investment and modernization. The country’s oil production has been in decline for years, due in part to a lack of investment and maintenance. By investing in Venezuela’s oil infrastructure, US companies could help increase production and efficiency, generating significant revenue in the process.

On the other hand, the notion that US companies will simply “start making money for the country” is overly simplistic. The reality is that investing in Venezuela’s oil industry is a complex and risky endeavor. The country’s economic and political instability, combined with the challenges of operating in a corrupt and bureaucratic environment, make it a daunting task for any company.

Moreover, there are also concerns about the environmental and social impact of increased oil production in Venezuela. The country’s oil industry has been criticized for its poor environmental record, and any investment in the sector would need to prioritize sustainability and social responsibility.

Despite these challenges, Trump’s statement reflects a broader trend in US policy towards Venezuela. The US has long been critical of Venezuela’s socialist government, and has imposed significant economic sanctions on the country in recent years. The idea that US companies can profit from investing in Venezuela’s oil industry, while also promoting American interests and values, is a key part of this policy.

It is worth noting, however, that Trump’s statement was made in the aftermath of a significant attack on Venezuela. The details of the attack are still unclear, but it is evident that the situation in Venezuela remains highly volatile and unpredictable. In this context, Trump’s statement can be seen as an attempt to assert American influence and interests in the region, while also promoting a narrative of American economic and technological superiority.

In conclusion, Trump’s statement about US companies investing in Venezuela’s oil industry and “making money for the country” reflects a complex and multifaceted issue. While there are certainly opportunities for US companies to profit from investing in Venezuela’s oil sector, there are also significant challenges and risks involved. As the situation in Venezuela continues to evolve, it will be important to watch how US policy towards the country develops, and how American companies navigate the complexities of investing in this critical sector.

News Source: https://www.youtube.com/watch