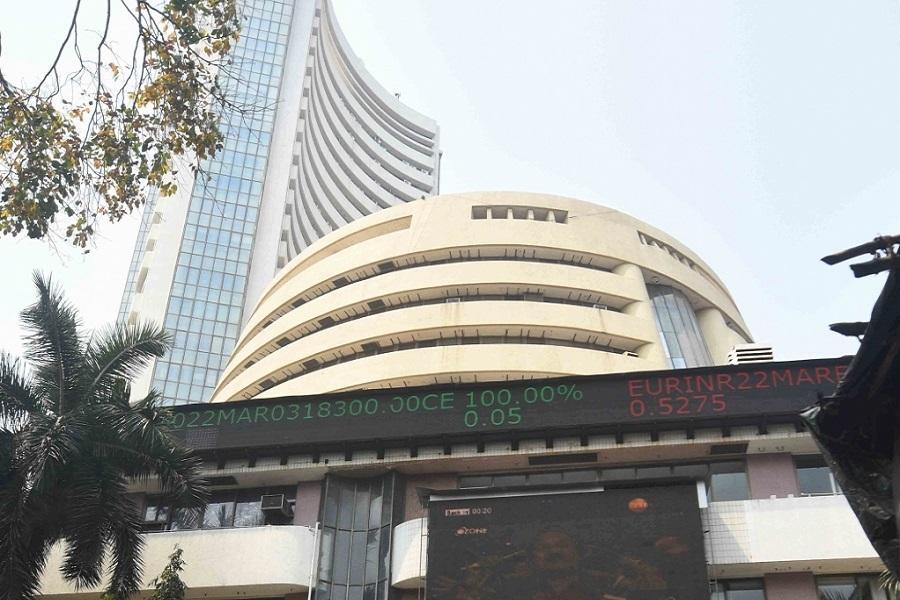

Sensex, Nifty End Higher Post ‘Operation Sindoor’

The Indian stock markets witnessed a volatile trading session on Wednesday, but managed to close in the green, alleviating concerns of investors. The Sensex erased all the early losses and closed with a gain of 105 points, or 0.13%, at 80,746. The Nifty, too, closed the intra-day trading session with a 0.14% gain at 24,414, reclaiming the crucial 24,400 mark.

This upward movement in the markets can be attributed to the ‘Operation Sindoor’ initiative launched by the Reserve Bank of India (RBI) to infuse liquidity and stabilize the financial system. The operation, which involves the sale of government securities, has helped to boost market sentiment and inject liquidity into the system.

The Sensex, which had opened on a negative note, recovered quickly as the day progressed. The index touched an intraday low of 80,444, but then rallied to close at 80,746, up 105 points. The Nifty, too, erased its early losses and closed at 24,414, up 34 points.

Market analysts attributed the upward movement to the RBI’s ‘Operation Sindoor’, which aims to inject liquidity into the system and stabilize the financial markets. The operation involves the sale of government securities to banks and financial institutions, which helps to increase the availability of funds in the market.

“This operation has helped to boost market sentiment and inject liquidity into the system,” said Rucha Wadhawan, a market analyst at a leading brokerage firm. “The RBI’s move has also helped to reduce the risk of a credit crunch, which was a major concern in the wake of the Moody’s downgrade.”

The Moody’s downgrade of India’s sovereign rating to ‘junk’ status had triggered concerns of a credit crunch, which could have led to a tightening of credit conditions and a reduction in economic activity. However, the RBI’s ‘Operation Sindoor’ has helped to alleviate these concerns, at least in the short term.

The ‘Operation Sindoor’ initiative is part of the RBI’s broader efforts to stabilize the financial system and promote economic growth. The RBI has taken a series of measures in recent weeks to boost liquidity and reduce market volatility, including the reduction of the repo rate and the injection of liquidity into the system.

The RBI’s efforts have been welcomed by market participants, who had been concerned about the impact of the Moody’s downgrade on the financial markets. The ‘Operation Sindoor’ initiative has helped to reduce market volatility and stabilize the financial system, at least in the short term.

“The RBI’s ‘Operation Sindoor’ has helped to restore confidence in the markets and reduce the risk of a credit crunch,” said Ravi Singh, a market analyst at a leading brokerage firm. “The RBI’s measures have also helped to reduce the risk of a sharp correction in the markets, which could have had a negative impact on the economy.”

The Sensex and Nifty have been trading volatile in recent weeks, driven by concerns about the impact of the Moody’s downgrade on the financial markets. The Sensex has been trading in a narrow range of 80,000-82,000, while the Nifty has been trading in a range of 24,200-24,600.

However, the ‘Operation Sindoor’ initiative has helped to break the cycle of volatility, and the Sensex and Nifty are now trading higher. The Sensex has broken above the 80,500 level, while the Nifty has reclaimed the crucial 24,400 mark.

The upward movement in the Sensex and Nifty is likely to continue in the short term, driven by the RBI’s ‘Operation Sindoor’ initiative and the reduction of market volatility. However, the markets are likely to remain volatile in the medium term, driven by concerns about the impact of the Moody’s downgrade on the financial markets.

In conclusion, the Sensex and Nifty ended higher post ‘Operation Sindoor’, alleviating concerns of investors and restoring confidence in the markets. The RBI’s initiative has helped to boost market sentiment and inject liquidity into the system, and has reduced the risk of a credit crunch and a sharp correction in the markets. However, the markets are likely to remain volatile in the medium term, driven by concerns about the impact of the Moody’s downgrade on the financial markets.

Source:

https://investmentguruindia.com/newsdetail/sensex-nifty-end-higher-post-operation-sindoor-584953