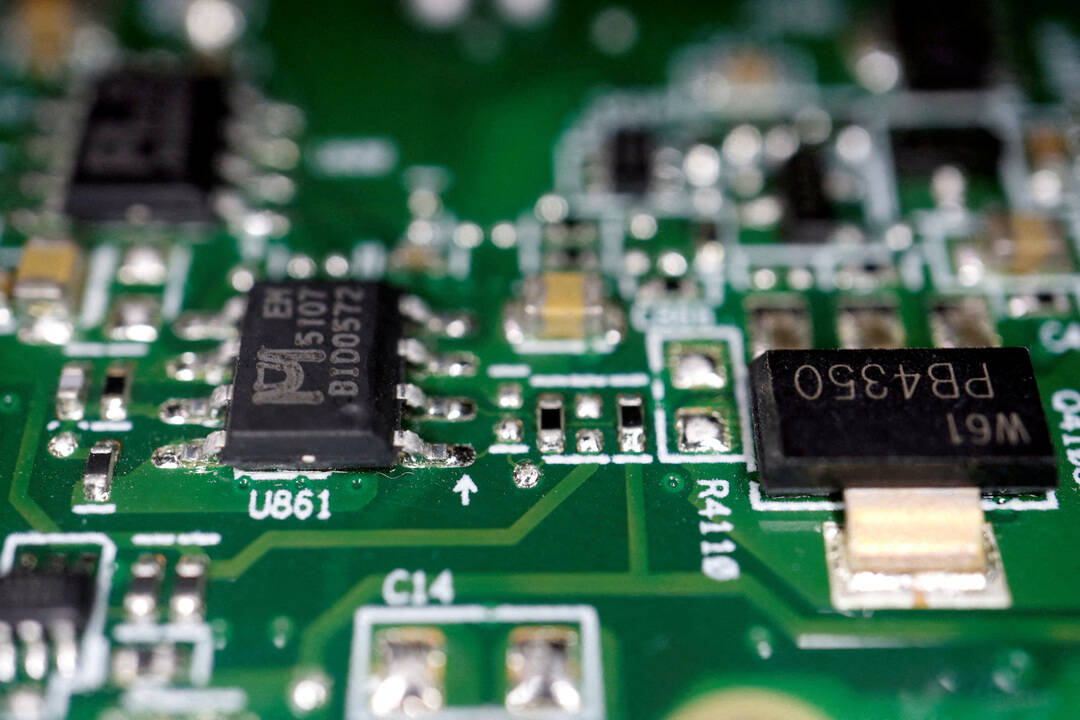

RRP Semiconductors, whose stocks rose 74,000% in 627 days, never manufactured semiconductors

The world of finance is no stranger to extraordinary stories of rapid growth and unprecedented success. However, the tale of RRP Semiconductors, a Maharashtra-based firm, takes the cake. In a span of just 627 days, or approximately 20 months, the company’s stock prices skyrocketed by a staggering 74,000%. This exponential rise has left many in the financial community scratching their heads, wondering what could have driven such an unprecedented surge. But, as it turns out, the truth behind RRP Semiconductors’ success is far more astonishing than anyone could have imagined.

At the heart of this story lies a company that, despite its name suggesting otherwise, has never actually manufactured semiconductors. Yes, you read that right. RRP Semiconductors, a firm whose stock prices rose to dizzying heights, has no history of producing semiconductors. This revelation has raised more questions than answers, leaving investors and regulators alike perplexed.

The company’s shares were recently halted from trading as they were put under surveillance measures due to their uncommon rise. This move was likely taken to prevent any potential market manipulation and to protect investors from potential losses. In a regulatory filing published on November 3, RRP Semiconductors accepted that it is “yet to start any sort of semiconductor manufacturing.” This admission has sparked a flurry of questions about the company’s business model, its future plans, and the reasons behind the extraordinary surge in its stock prices.

So, what could have driven the stock prices of RRP Semiconductors to such dizzying heights? The answer, much like the company’s business model, remains shrouded in mystery. Some analysts have speculated that the rise could be attributed to speculation and hype surrounding the semiconductor industry as a whole. Others have pointed to potential market manipulation, where a small group of investors may have artificially inflated the stock prices to reap quick profits.

The fact that RRP Semiconductors has only two employees has also raised eyebrows. How can a company with such a small workforce possibly justify a market capitalization that has grown exponentially in such a short span? The lack of transparency and clarity surrounding the company’s operations has only added to the confusion.

As the story of RRP Semiconductors continues to unfold, it serves as a stark reminder of the risks and uncertainties associated with investing in the stock market. While the prospect of making quick profits can be alluring, it is essential for investors to exercise caution and do their due diligence before investing in any company.

In the case of RRP Semiconductors, the writing was on the wall. The company’s lack of a clear business model, its non-existent semiconductor manufacturing operations, and its tiny workforce should have raised red flags for investors. However, in the heat of the moment, many investors got caught up in the hype, hoping to ride the wave of the company’s soaring stock prices.

As regulators continue to investigate the circumstances surrounding RRP Semiconductors’ extraordinary rise, one thing is clear: the story of this Maharashtra-based firm serves as a cautionary tale for investors. It highlights the importance of doing thorough research, exercising patience, and avoiding getting caught up in the hype surrounding any particular stock or industry.

In conclusion, the story of RRP Semiconductors is a reminder that the stock market can be unpredictable and unforgiving. While the prospect of making quick profits can be tempting, it is essential for investors to prioritize caution and prudence. As the dust settles on this extraordinary tale, one thing is certain: the story of RRP Semiconductors will serve as a lesson for investors and regulators alike for years to come.

News Source: https://www.news18.com/amp/viral/stocks-of-indian-company-with-just-2-workers-see-55000-surge-aa-ws-l-9782647.html