RRP Semiconductors, whose stocks rose 74,000% in 627 days, never manufactured semiconductors

In a shocking turn of events, it has come to light that RRP Semiconductors, a Maharashtra-based firm whose stock skyrocketed 74,000% in just 627 days (or 20 months), has never manufactured semiconductors. This revelation has left investors and market regulators stunned, as the company’s shares were halted for trading due to their uncommon rise. The company’s acceptance of not having started semiconductor manufacturing has raised several questions about the legitimacy of its business operations and the sudden surge in its stock prices.

The company’s stock prices began to rise rapidly in 2020, with a significant increase in trading volumes. The stocks were traded heavily, with many investors buying into the company’s potential for growth in the semiconductor industry. However, it now appears that the company’s claims of being a semiconductor manufacturer were grossly exaggerated. In a regulatory filing published on November 3, the company had accepted that it is “yet to start any sort of semiconductor manufacturing”. This admission has sparked concerns about the company’s intentions and the potential for market manipulation.

The Securities and Exchange Board of India (SEBI) has taken notice of the unusual price movement in the company’s stocks and has put them under surveillance measures. The regulator is investigating the matter to determine if there were any irregularities or manipulative practices involved in the trading of the company’s shares. The investigation is expected to reveal more about the company’s activities and the reasons behind the sudden surge in its stock prices.

The case of RRP Semiconductors highlights the risks associated with investing in the stock market, particularly in companies with little or no track record. Investors often get caught up in the hype surrounding a company’s potential for growth, without conducting thorough research or due diligence. The lack of transparency and accountability in some companies can lead to market manipulation and unfair practices, which can result in significant losses for investors.

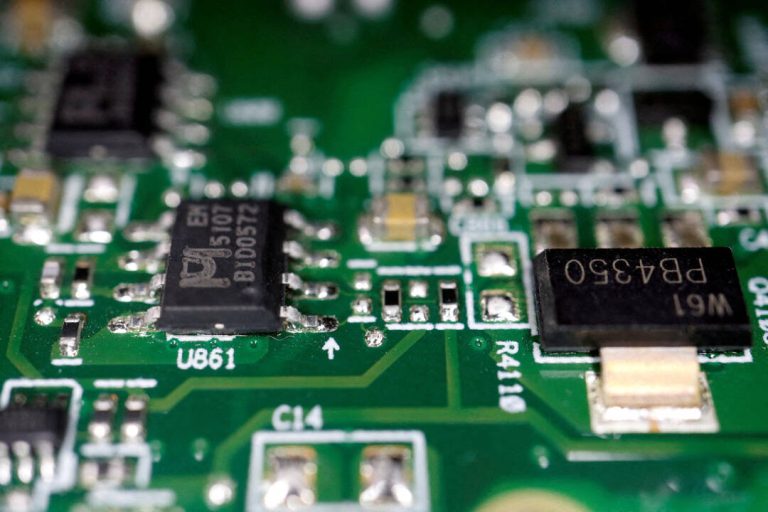

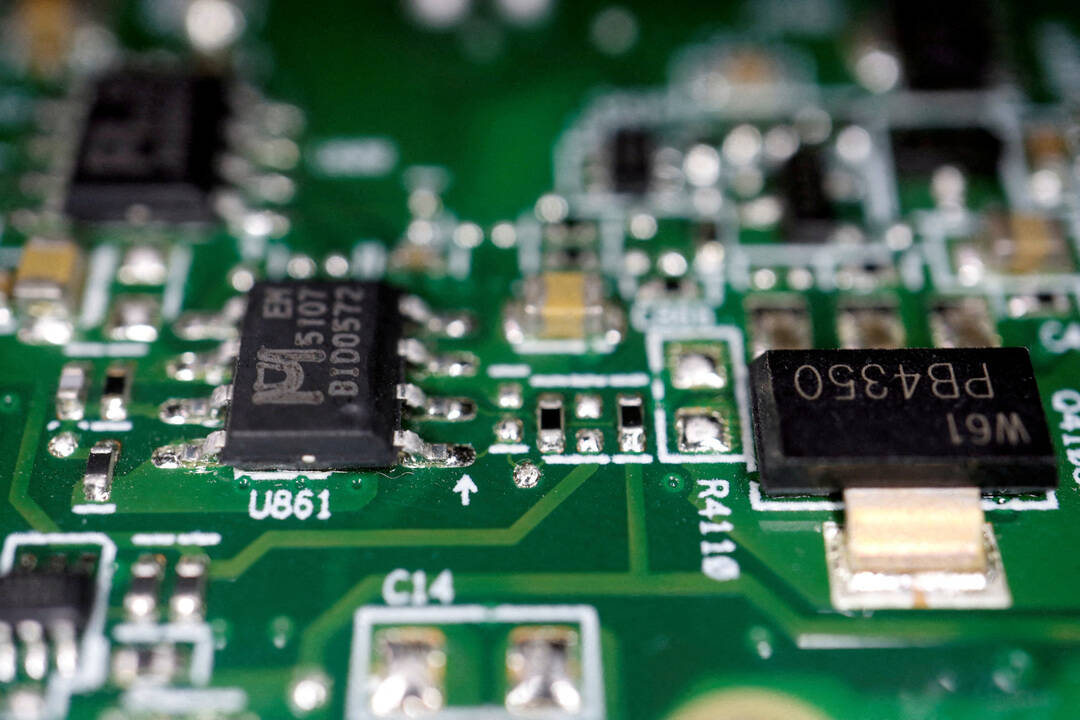

The semiconductor industry is a complex and highly competitive sector, requiring significant investments in research and development, manufacturing, and technology. It is unlikely that a company with only two employees, as reported, could establish itself as a major player in the industry without any significant investments or partnerships. The company’s claims of being a semiconductor manufacturer appear to be nothing more than a ruse to attract investors and inflate its stock prices.

The regulatory environment in India has been strengthened in recent years, with SEBI taking a more proactive approach to monitoring and regulating the stock market. The regulator has introduced several measures to prevent market manipulation and protect investor interests. However, the case of RRP Semiconductors highlights the need for continued vigilance and stricter regulations to prevent such incidents in the future.

In conclusion, the case of RRP Semiconductors is a cautionary tale for investors and a reminder of the importance of conducting thorough research and due diligence before investing in the stock market. The company’s acceptance of not having started semiconductor manufacturing has raised significant questions about its business operations and the legitimacy of its stock prices. As the investigation into the matter continues, it is essential for investors to remain vigilant and cautious, and for regulators to take swift and decisive action to prevent such incidents in the future.

The sudden surge in the company’s stock prices has also raised questions about the role of market intermediaries, such as brokers and financial advisors, in promoting the company’s shares. It is essential to investigate whether any of these intermediaries were involved in promoting the company’s shares or engaging in any manipulative practices.

The case of RRP Semiconductors also highlights the need for greater transparency and accountability in corporate governance. The company’s failure to disclose its true business operations and intentions has resulted in significant losses for investors and damage to the reputation of the stock market. It is essential for companies to maintain the highest standards of corporate governance and transparency to ensure that investors have access to accurate and reliable information.

In the end, the case of RRP Semiconductors serves as a reminder of the risks and challenges associated with investing in the stock market. While the potential for high returns is significant, the risks of losses are equally high. It is essential for investors to approach the stock market with caution and to conduct thorough research and due diligence before making any investment decisions.

News Source: https://www.news18.com/amp/viral/stocks-of-indian-company-with-just-2-workers-see-55000-surge-aa-ws-l-9782647.html