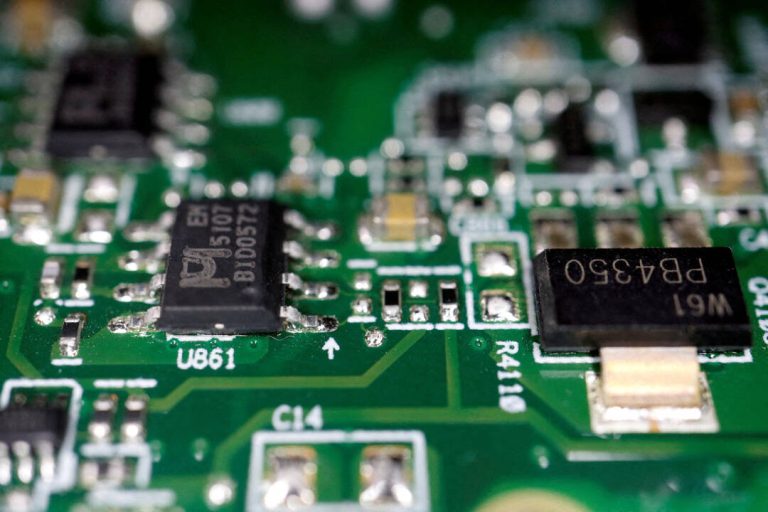

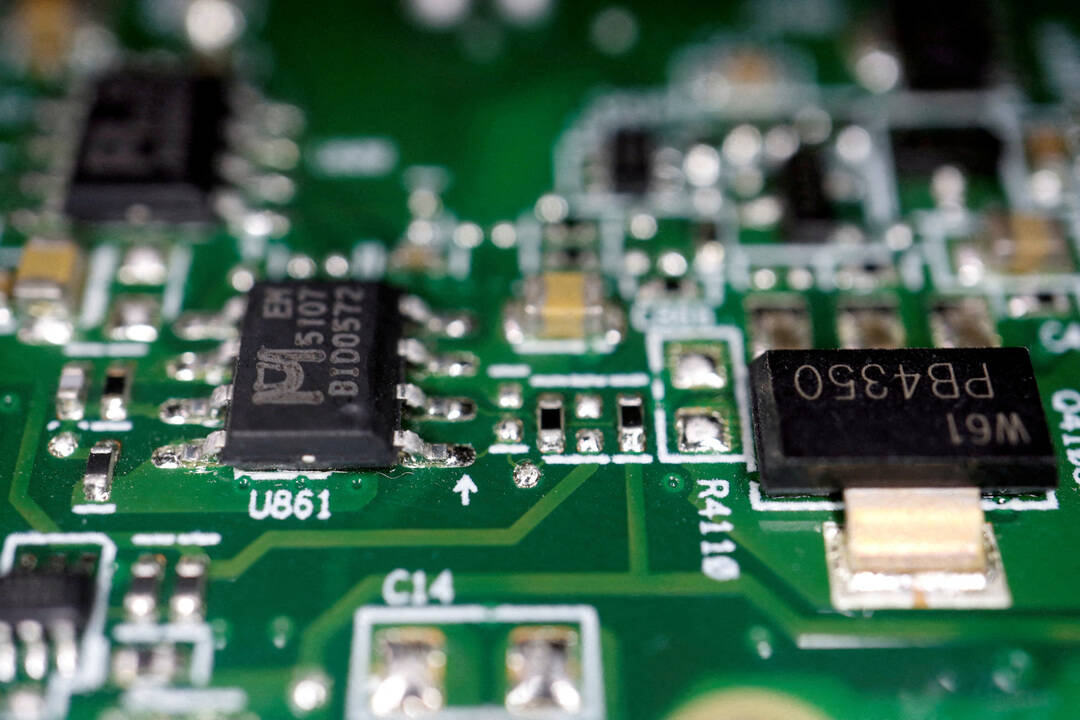

RRP Semiconductors, whose stocks rose 74,000% in 627 days, never manufactured semiconductors

In a shocking revelation, RRP Semiconductors, a Maharashtra-based firm, has been found to have never manufactured semiconductors, despite its stock price skyrocketing by a staggering 74,000% in just 627 days, or approximately 20 months. This unprecedented rise in the company’s stock price has raised eyebrows and sparked an investigation into the matter. As a result, the company’s shares have been halted for trading, and it has been put under surveillance measures by regulatory authorities.

The astonishing growth in RRP Semiconductors’ stock price is a rare occurrence in the Indian stock market. The company’s shares were trading at a mere ₹0.36 on February 24, 2021, but by October 11, 2022, they had surged to an astonishing ₹267.15, representing a whopping 74,000% increase. This kind of growth is unheard of, even in the most successful and established companies. To put this into perspective, if an investor had invested ₹1 lakh in RRP Semiconductors’ shares in February 2021, their investment would have grown to a staggering ₹74 lakhs by October 2022.

However, what’s even more shocking is that RRP Semiconductors has never actually manufactured semiconductors. In a regulatory filing published on November 3, the company accepted that it is “yet to start any sort of semiconductor manufacturing.” This raises questions about the company’s business model and the reasons behind the sudden and unexpected surge in its stock price.

The company’s lack of manufacturing activities is not the only red flag. RRP Semiconductors has a very small team, with only two employees on its payroll. This is unusual for a company that claims to be in the business of manufacturing semiconductors, a complex and capital-intensive industry that typically requires a large team of skilled engineers and technicians.

The regulatory authorities have taken notice of the unusual activities surrounding RRP Semiconductors and have launched an investigation into the matter. The company’s shares have been halted for trading, and it has been put under surveillance measures to prevent any further unusual price movements.

The incident highlights the risks and challenges associated with investing in the stock market. While the stock market can offer high returns on investment, it also comes with its own set of risks and uncertainties. Investors need to be cautious and do their due diligence before investing in any company, especially those with unusual or unexplained price movements.

The RRP Semiconductors incident also raises questions about the effectiveness of regulatory authorities in monitoring and controlling the stock market. While the authorities have taken action in this case, it is unclear why they did not detect the unusual activities surrounding the company earlier.

In conclusion, the RRP Semiconductors incident is a shocking example of how a company’s stock price can surge without any underlying fundamental reasons. The company’s lack of manufacturing activities, small team, and unusual price movements all raise red flags and highlight the need for investors to be cautious and vigilant when investing in the stock market.

As the investigation into the matter continues, it will be interesting to see what actions the regulatory authorities take against RRP Semiconductors and what measures they put in place to prevent such incidents in the future.