Retail Turns Bullish on Apellis after FDA Kidney Drug Nod

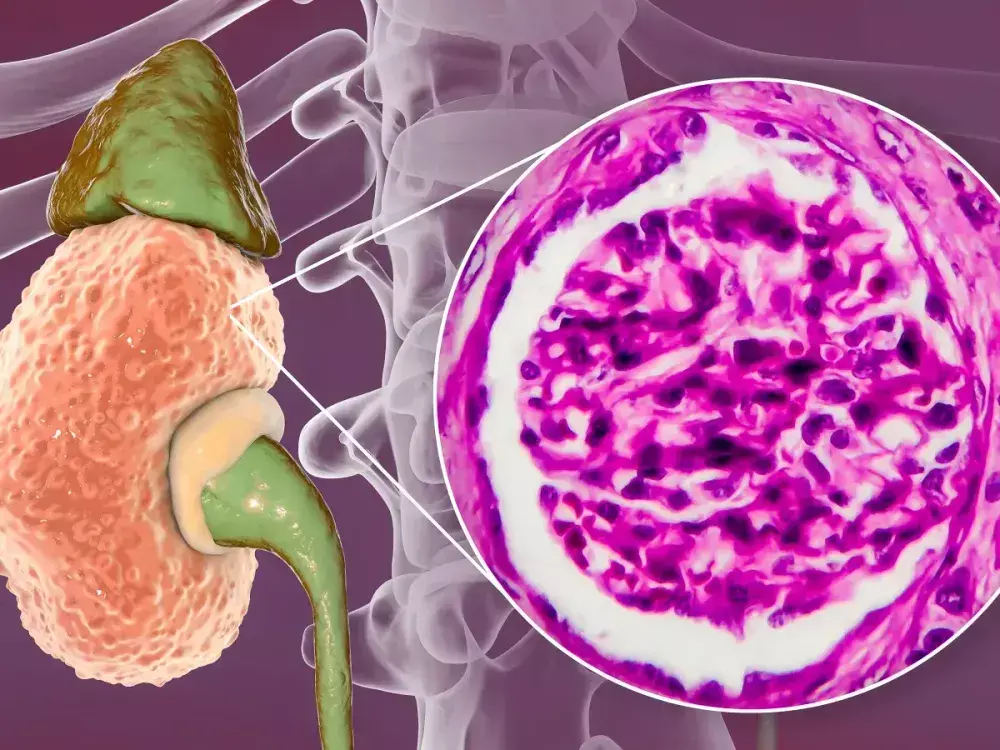

The pharmaceutical industry has been abuzz with excitement lately, and one company that has taken center stage is Apellis Pharmaceuticals. The FDA’s recent approval of Empaveli, a treatment for two rare kidney diseases, has sent the company’s stock soaring, and retail investors are leading the charge.

Apellis’ Empaveli is a game-changer for patients suffering from C3G and IC-MPGN, two rare and debilitating kidney diseases that affect around 5,000 people in the US. The drug’s approval was based on strong Phase 3 data, which demonstrated its efficacy in treating these conditions.

The news sent shockwaves through the financial markets, with analysts at Baird, Morgan Stanley, and BofA raising their price targets for Apellis’ stock. But it’s not just the analysts who are bullish on the company – retail investors are also piling in, driving the stock’s price up and sentiment to extremely bullish levels.

According to Stocktwits, a platform that tracks sentiment and activity on social media, the number of messages about Apellis surged by an astonishing 2,350% in the days following the FDA’s announcement. This surge in activity is a clear indication of the excitement and optimism surrounding the company’s prospects.

So, what’s behind the sudden surge in retail interest in Apellis? There are several factors at play. First and foremost, the FDA’s approval of Empaveli is a major coup for the company, and it’s likely to lead to significant revenue growth in the coming years. With a rare disease franchise, Apellis has a unique opportunity to become a leader in its field and build a loyal customer base.

Another factor driving retail interest is the company’s strong Phase 3 data. The fact that Empaveli demonstrated efficacy in treating C3G and IC-MPGN is a major selling point for investors, who are eager to get in on the ground floor of a company with a promising new treatment.

Finally, there’s the broader trend of retail investors becoming more involved in the stock market. With the rise of online trading platforms and social media, it’s easier than ever for individual investors to research and buy stocks. This increased participation has led to a surge in retail activity on platforms like Stocktwits, where investors can share their thoughts and opinions on individual stocks.

The data on Apellis is compelling, and it’s no wonder that retail investors are piling in. With a strong product and a rare disease franchise, the company has a unique opportunity to build a loyal customer base and drive long-term growth.

Of course, it’s always important to do your own research and consult with a financial advisor before making any investment decisions. But for those who are interested in getting in on the action, Apellis is definitely worth a closer look.