Man Finds JSW Shares His Father Bought in 1990s, Stock Investor Says They’re Worth ₹80 Cr Now

The world of stock investing can be unpredictable, with prices fluctuating wildly and fortunes being made and lost in the blink of an eye. However, there are some exceptions to this rule – and one such example is the remarkable story of Sourav Dutta, a stock market investor who recently discovered that his father had purchased 5,000 shares of Jindal Vijayanagar Steel, now a part of JSW Steel, back in the 1990s. According to Dutta, these shares are now worth a staggering ₹80 crore.

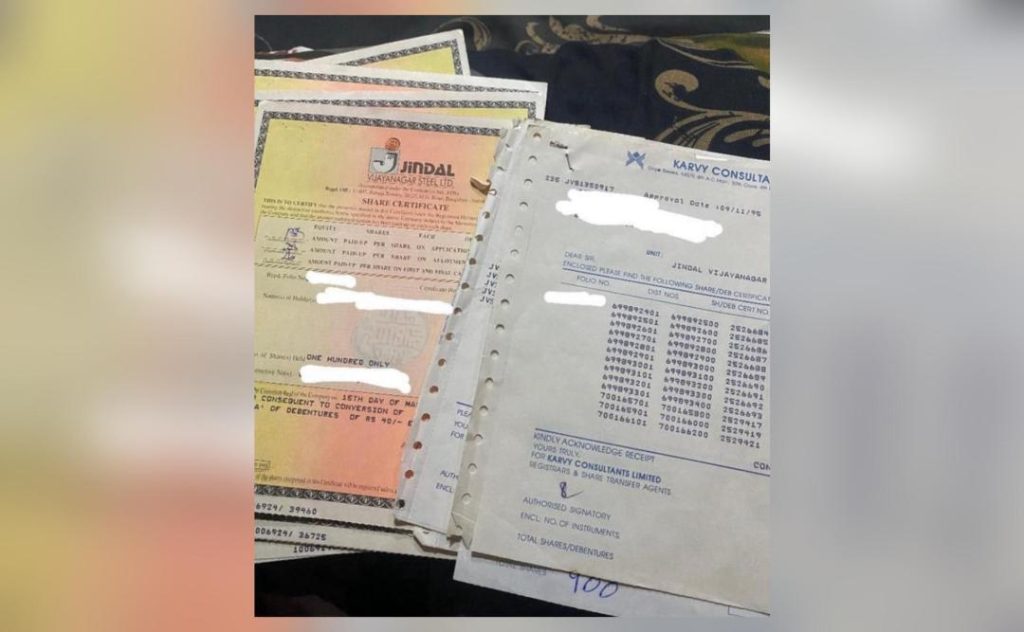

Dutta, a self-proclaimed stock market enthusiast, took to social media platform Reddit to share his incredible discovery. He posted a picture of the original share certificates, which dated back to the 1990s, along with a brief explanation of his father’s investment. According to Dutta, his father had purchased the shares for a mere ₹1 lakh, which is approximately ₹25,000 in today’s money.

The incredible thing about Dutta’s story is that he only recently stumbled upon the shares, which had been lying in a drawer or a bank locker for decades. It’s a reminder that even the most seemingly insignificant investments can turn out to be incredibly lucrative over time.

Dutta’s story has sent shockwaves through the stock market community, with many investors and analysts marveling at the incredible returns on his father’s investment. As Dutta himself put it, “Power of buy right, sell after 30 years.”

But what makes Dutta’s story even more remarkable is the fact that his father had no idea about the true value of the shares. It wasn’t until Dutta took a closer look at the certificates that he realized the magnitude of their worth.

“I was going through some old documents and came across the share certificates,” Dutta explained in his Reddit post. “I was shocked to see that the shares were still valid and had not been dematerialized. I then checked the current market price and was amazed to see that the value of the shares had skyrocketed.”

Dutta’s story is a stark reminder of the power of long-term investing. While many investors might be tempted to make quick profits by buying and selling shares rapidly, Dutta’s experience shows that patience and perseverance can be incredibly rewarding.

Of course, there are no guarantees in the stock market, and investors can never be certain of the returns on their investments. However, Dutta’s story provides a powerful reminder of the importance of having a long-term perspective and being willing to ride out market fluctuations.

As for Dutta, he is now planning to hold onto the shares and let them continue to appreciate in value. He is also considering using some of the proceeds to invest in other stocks and assets, in the hopes of generating even more returns.

In conclusion, Dutta’s remarkable story is a testament to the power of long-term investing and the importance of having a patient and disciplined approach to the stock market. While there is always an element of risk involved, the potential rewards can be incredibly lucrative – as Dutta’s father’s 5,000 shares of JSW Steel have so amply demonstrated.