Laurus Labs May See a Pullback after Overbought Rally

Laurus Labs, a leading pharmaceutical company, has been on a tear lately, with its stock price surging by 20% in just 11 trading days. While this rally has excited investors, some analysts are sounding the warning bell, cautioning that the stock may be due for a pullback. In this blog post, we’ll examine the technical indicators that suggest Laurus Labs may face short-term profit booking and what traders can do to position themselves for a potential rebound.

Overbought Conditions

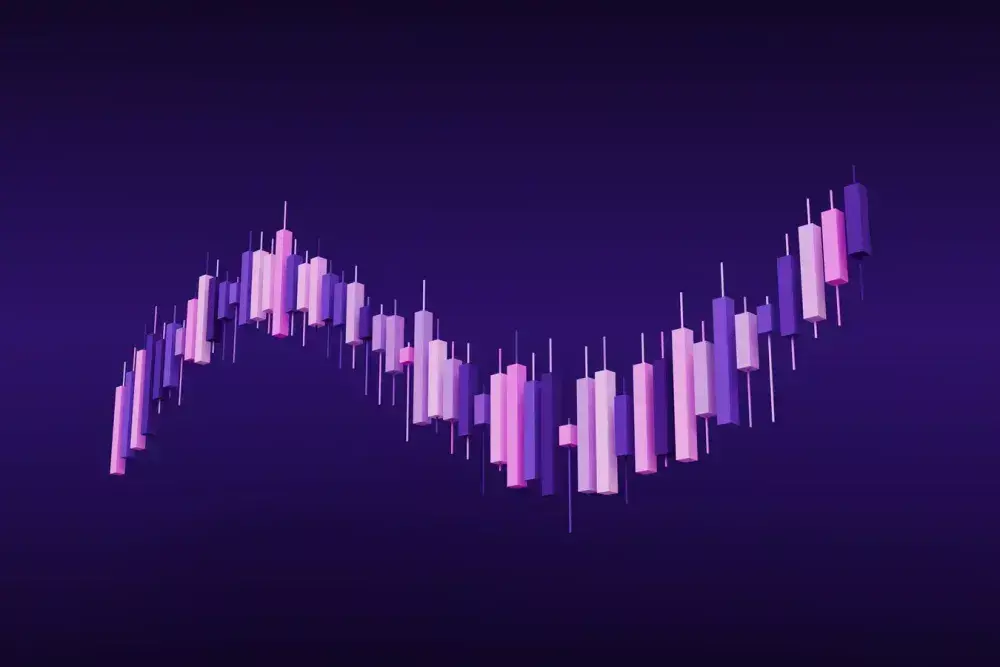

One of the primary indicators used to assess the stock’s technical condition is the Relative Strength Index (RSI). The RSI measures the magnitude of recent price changes to determine overbought or oversold conditions. At the moment, Laurus Labs’ RSI stands at 83, which is considered overbought. This suggests that the stock has been trending upward for a prolonged period, leading to a situation where it may be due for a correction.

Candlesticks Outside Bollinger Bands

Another technical indicator that supports the notion of an overbought condition is the candlesticks outside Bollinger Bands. The Bollinger Bands are a volatility indicator that consists of a moving average and two standard deviations plotted above and below it. When a stock’s price moves outside these bands, it can indicate overextension, which may lead to a reversal.

In the case of Laurus Labs, the stock’s price has broken out above the upper Bollinger Band, which is a sign of overextension. This, combined with the overbought RSI, suggests that the stock may be due for a pullback.

A Pullback to the 20-Day Moving Average

A pullback to the 20-day moving average (20-DMA) could provide a healthier entry point for traders. The 20-DMA is a widely followed indicator that helps identify the stock’s short-term trend. A pullback to this level could offer a buying opportunity, as it would allow traders to enter the market at a relatively low price.

What Traders Can Do

So, what can traders do in the face of an overbought stock like Laurus Labs? Here are a few strategies to consider:

- Take Profits: If you’re long Laurus Labs, consider taking some profits off the table and booking your gains. A pullback could provide a better entry point for future trades.

- Wait for a Pullback: As mentioned earlier, a pullback to the 20-DMA could provide a healthier entry point. Traders can wait for the stock to reach this level before entering a new position.

- Short-Sell: For traders who believe the rally has gone too far, short-selling Laurus Labs could be a viable strategy. However, this approach comes with significant risks and should be approached with caution.

Conclusion

Laurus Labs’ impressive 11-day rally has left many investors wondering if the stock has reached its ceiling. While it’s impossible to predict with certainty, the technical indicators suggest that the stock may be due for a pullback. A pullback to the 20-DMA could provide a healthier entry point for traders, while those who are long the stock may want to consider taking some profits off the table. As always, it’s essential to stay informed and adapt your strategy to changing market conditions.

Source: