Karnataka Traders on Strike to Protest GST on UPI

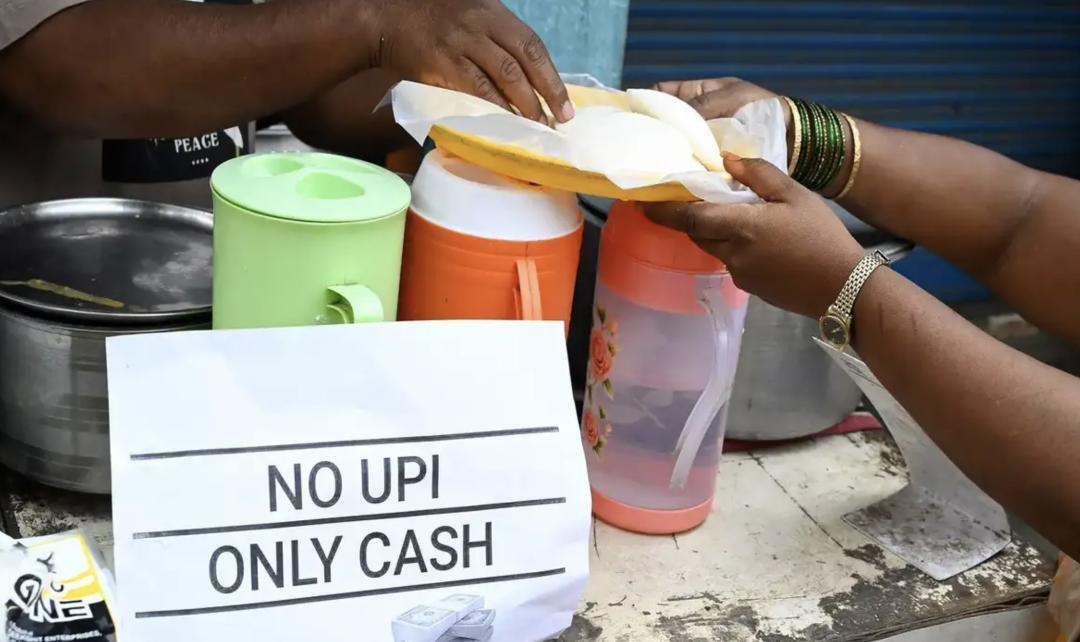

In a bold move, traders in Karnataka have announced a statewide bandh (strike) on July 25 to protest against the Goods and Services Tax (GST) notices issued based on Unified Payments Interface (UPI) transaction data. The notices have sparked widespread concern among traders, who fear confusion over exempted goods and personal payments. The situation has led to a standoff between traders and tax officials, with both parties holding different views on the issue.

According to reports, over 6,000 GST notices have been issued to traders in Karnataka, many of whom are small-time businessmen who rely on UPI transactions for daily business operations. The notices are based on the transaction data, which has raised concerns among traders about the accuracy and reliability of the information. Many traders are worried that they may end up paying GST on exempted goods or services, which could lead to significant financial losses.

Tax officials, on the other hand, claim that the notices are purely preliminary and are meant to encourage traders to maintain proper documentation. They argue that the notices are not final and that traders can file objections and appeals if they feel that the information is incorrect. However, critics argue that the lack of clarity and education on the GST regime has led to widespread confusion among traders, who are struggling to understand the new tax regime.

The issue has taken a political turn, with opposition parties in Karnataka joining the protest and demanding that the state government take immediate action to resolve the issue. The state government has so far maintained that it is not responsible for the GST notices and that the matter is with the central government. However, the opposition parties have accused the government of being insensitive to the plight of traders and have demanded that it take steps to address their concerns.

The bandh on July 25 is expected to disrupt normal life in Karnataka, with shops, markets, and other businesses likely to remain shut. The strike has also been supported by several trade associations and chambers of commerce, which have called upon the state government to take immediate action to resolve the issue.

The controversy surrounding GST notices based on UPI transaction data is not new. In the past, there have been several instances where tax officials have used transaction data to issue notices to taxpayers. However, the current situation in Karnataka is unique because of the sheer number of notices issued and the widespread concern among traders.

The issue has also raised concerns about the security and integrity of UPI transaction data. Traders are worried that the data could be misused by tax officials or other third parties, which could lead to serious financial losses and reputational damage. The Reserve Bank of India (RBI) has so far maintained that UPI transaction data is secure and that it has adequate measures in place to prevent misuse.

In conclusion, the strike by Karnataka traders is a clear indication of the widespread discontent among traders about the GST notices issued based on UPI transaction data. The issue has raised important questions about the accuracy and reliability of transaction data, the need for better education and clarity on the GST regime, and the importance of adequate exemptions and safeguards for small-time traders. As the situation unfolds, it will be interesting to see how the state government and tax officials respond to the concerns of traders and address their demands.