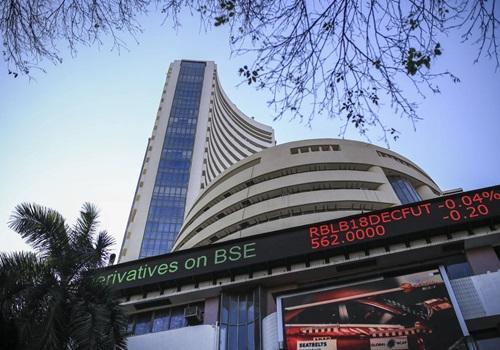

Indian Equity Indices Decline Sharply Over US Tariff Concerns

The Indian equity indices fell sharply to end the session nearly one per cent lower on Thursday, a day after the 50 per cent US tariffs on Indian goods came into effect. The benchmark indices, Sensex and Nifty, witnessed a significant decline, with the Nifty settling at 24,500.90, down 211.15 points or 0.85 per cent.

The decline in the Indian equity indices was largely due to the concerns over the impact of the US tariffs on Indian goods. The tariffs, which came into effect on Friday, are expected to have a significant impact on the Indian economy, particularly on the export-oriented sectors. The Indian government has been trying to negotiate with the US to reduce the tariffs, but so far, there has been no breakthrough.

The Sensex and Nifty both opened lower and remained under pressure throughout the session. The Sensex fell as much as 434.45 points or 0.93 per cent to 80,313.15, before recovering some lost ground to end at 80,555.10, down 274.15 points or 0.34 per cent.

The decline in the Indian equity indices was led by the metal and FMCG sectors, which were the most affected by the US tariffs. The metal sector was down 2.3 per cent, with Tata Steel and JSW Steel falling 4.5 per cent and 3.4 per cent, respectively. The FMCG sector was down 1.5 per cent, with Hindustan Unilever and ITC falling 2.3 per cent and 1.8 per cent, respectively.

However, some stocks managed to buck the trend and rise despite the overall decline in the market. Shilpa Medicare, a pharmaceutical company, was one such stock that jumped 14.5 per cent after it announced that its arm, Shilpa Medicare Biotech, was forming a new joint venture company in Saudi Arabia. The joint venture company will focus on manufacturing and marketing of pharmaceutical products in Saudi Arabia and other Gulf Cooperation Council (GCC) countries.

Other stocks that rose on Thursday included Bharti Infratel, which was up 2.5 per cent, and SBI Life Insurance, which was up 2.2 per cent.

The decline in the Indian equity indices was also attributed to the weakness in the rupee, which fell 0.4 per cent against the US dollar. The rupee has been under pressure in recent weeks, due to the rise in global crude oil prices and the decline in the value of the US dollar.

The decline in the Indian equity indices has raised concerns about the impact of the US tariffs on the Indian economy. The Indian government has been trying to mitigate the impact of the tariffs by providing support to the affected industries and by negotiating with the US to reduce the tariffs. However, the decline in the equity indices suggests that the impact of the tariffs may be more significant than initially thought.

In conclusion, the Indian equity indices fell sharply on Thursday, largely due to concerns over the impact of the US tariffs on Indian goods. The decline in the indices was led by the metal and FMCG sectors, with some stocks, such as Shilpa Medicare, bucking the trend and rising despite the overall decline. The weakness in the rupee also contributed to the decline in the indices.