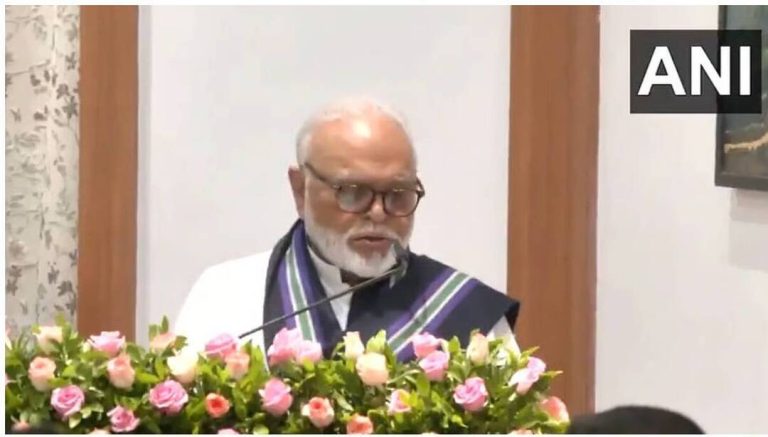

Nifty likely to see 15% return in 2026: Helios founder Samir Arora

The Indian market, which has been experiencing a rollercoaster ride in recent times, is expected to bounce back in 2026, with a predicted 15% return in Nifty, according to Samir Arora, founder of Helios Capital. This optimistic forecast comes as a welcome respite for investors who have been navigating the choppy waters of the market. In a recent statement, Arora explained that despite the current volatility, the prospects for the next year look promising, with India outperforming most other markets from October onwards.

To put this into perspective, Arora pointed out that since March, the midcap index has seen a significant uptick of 25%, while the smallcap index has risen by 18-20%. However, he cautioned that the market still needs to overcome the challenges that arose between September 2024 and March 2025. This period was marked by significant uncertainty and instability, which had a profound impact on investor sentiment.

Arora’s statement suggests that the Indian market is poised for a strong recovery in 2026, driven by a combination of factors, including improved economic fundamentals, a rebound in corporate earnings, and a favorable policy environment. The predicted 15% return in Nifty would be a significant boost to investor confidence, which has been shaken in recent times by the market’s volatility.

One of the key drivers of the expected recovery is the performance of midcap and smallcap stocks. These segments of the market have been outperforming their larger counterparts, with the midcap index rising by 25% since March. This is a significant trend, as midcap and smallcap stocks are often seen as a bellwether for the broader market. Their strong performance suggests that investors are becoming more confident in the growth prospects of these companies, which could have a positive knock-on effect on the overall market.

Another factor that is likely to contribute to the market’s recovery is the improving economic fundamentals. The Indian economy has been showing signs of resilience, with a strong rebound in growth, driven by a combination of factors, including government spending, private consumption, and investment. This uptick in economic activity is likely to have a positive impact on corporate earnings, which in turn could drive the market higher.

Furthermore, the policy environment is also becoming more favorable, with the government taking steps to boost growth and investment. The recent budget, for example, included a number of measures aimed at stimulating economic activity, including tax cuts and increased spending on infrastructure. These initiatives are likely to have a positive impact on the market, as they are seen as supportive of growth and investment.

Arora’s statement also highlights the fact that India is outperforming most other markets from October onwards. This is a significant trend, as it suggests that the Indian market is becoming increasingly attractive to investors, who are seeking to capitalize on the country’s growth prospects. The fact that India is outperforming other markets is a testament to the country’s strong economic fundamentals, as well as its favorable policy environment.

In conclusion, the Indian market is expected to see a significant recovery in 2026, with a predicted 15% return in Nifty. This forecast is driven by a combination of factors, including the strong performance of midcap and smallcap stocks, improving economic fundamentals, and a favorable policy environment. As Arora noted, the prospects for the next year look good, with India outperforming most other markets from October onwards. While there are still challenges to be overcome, the outlook for the Indian market is increasingly positive, and investors who are willing to take a long-term view are likely to be rewarded.

As the market continues to evolve, it will be important to keep a close eye on the trends and developments that are shaping the investment landscape. With the predicted 15% return in Nifty, investors who are looking to capitalize on the Indian market’s growth prospects would do well to consider the opportunities that are available. Whether you are a seasoned investor or just starting out, it is essential to stay informed and up-to-date on the latest market trends and developments.

In the end, the key to success in the market is to stay informed, be patient, and have a long-term perspective. As Arora’s statement suggests, the Indian market is poised for a strong recovery in 2026, and investors who are willing to take a long-term view are likely to be rewarded. With its strong economic fundamentals, favorable policy environment, and attractive growth prospects, the Indian market is an exciting opportunity for investors who are looking to capitalize on the country’s growth story.

News Source: https://www.ndtvprofit.com/amp/markets/how-much-return-will-nifty-give-in-2026-samir-arora-weighs-in