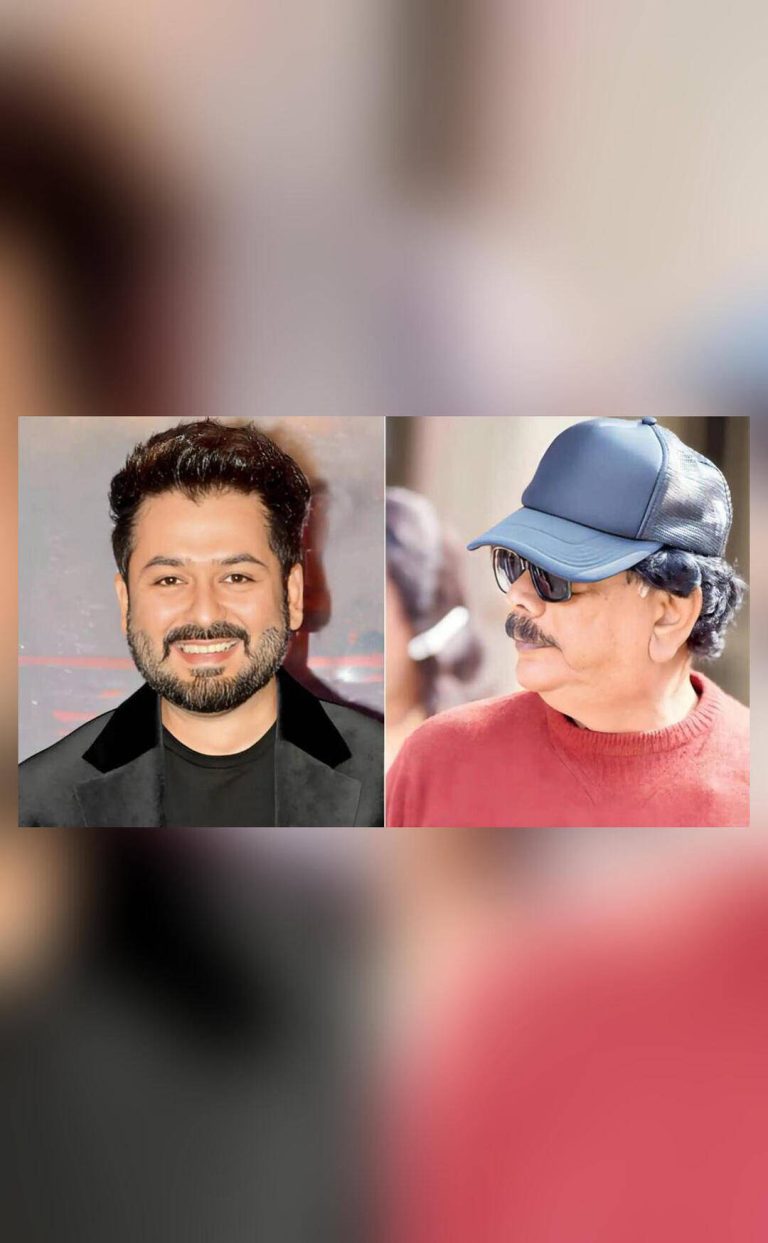

Nifty likely to see 15% return in 2026: Helios founder Samir Arora

The Indian market has been a subject of interest for investors and experts alike, with many trying to gauge its future performance. According to Helios Capital founder Samir Arora, the Nifty is expected to see a 15% return in 2026. This prediction comes after a tumultuous period for the market, which has been navigating through various challenges. In this blog post, we will delve into Arora’s statement and explore the factors that could contribute to the Nifty’s potential growth.

Arora’s statement is based on the market’s current trend, which has shown significant improvement since March. The midcap index has risen by 25%, while the smallcap index has seen an increase of 18-20%. However, Arora cautions that the market has not yet fully recovered from the downturn that occurred between September 2024 and March 2025. Despite this, he remains optimistic about the prospects for the next year, stating that “from October onwards, India’s doing better than most markets.”

This statement suggests that the Indian market has been performing relatively well compared to other global markets. This could be attributed to various factors, including the country’s strong economic fundamentals, government initiatives, and the resilience of Indian businesses. The fact that the midcap and smallcap indices have seen significant growth since March indicates that investors are becoming more confident in the market’s potential.

Arora’s prediction of a 15% return in the Nifty in 2026 is based on his analysis of the market’s trends and factors. While this may seem like a modest return, it is essential to consider the current market conditions and the challenges that the Indian economy has faced in recent times. The market’s ability to bounce back from the downturn and show signs of growth is a positive indicator of its resilience and potential for future growth.

One of the key factors that could contribute to the Nifty’s growth in 2026 is the government’s initiatives to boost economic growth. The government has been taking steps to improve the business environment, increase investment, and enhance infrastructure. These initiatives could lead to increased economic activity, which in turn could drive growth in the stock market.

Another factor that could contribute to the Nifty’s growth is the performance of Indian businesses. Many Indian companies have been showing strong growth and resilience in the face of challenges, which could lead to increased investor confidence and higher stock prices. The fact that the midcap and smallcap indices have seen significant growth since March suggests that investors are becoming more confident in the potential of Indian businesses.

In addition to these factors, the global economic trends could also play a role in the Nifty’s performance in 2026. The global economy has been facing various challenges, including trade tensions, Brexit, and the COVID-19 pandemic. However, the Indian market has been relatively resilient, and its performance has been better than many other global markets. This could be attributed to the country’s strong economic fundamentals and the government’s initiatives to boost growth.

In conclusion, Samir Arora’s prediction of a 15% return in the Nifty in 2026 is based on his analysis of the market’s trends and factors. While this may seem like a modest return, it is essential to consider the current market conditions and the challenges that the Indian economy has faced in recent times. The market’s ability to bounce back from the downturn and show signs of growth is a positive indicator of its resilience and potential for future growth. With the government’s initiatives to boost economic growth, the strong performance of Indian businesses, and the relatively resilient global economic trends, the Nifty is likely to see significant growth in 2026.

As Arora stated, “Prospects for next year look good….From October onwards, India’s doing better than most markets.” This statement suggests that the Indian market is poised for growth, and investors could see significant returns in the coming year. However, it is essential to remember that the stock market is subject to various risks and uncertainties, and investors should always do their own research and consult with financial experts before making any investment decisions.

Overall, the Indian market’s expected to bounce back, with 15% return in Nifty in 2026, said Helios Capital founder Samir Arora. His statement is based on the market’s current trend, which has shown significant improvement since March. With the government’s initiatives to boost economic growth, the strong performance of Indian businesses, and the relatively resilient global economic trends, the Nifty is likely to see significant growth in 2026.

Source: https://www.ndtvprofit.com/amp/markets/how-much-return-will-nifty-give-in-2026-samir-arora-weighs-in