CBI files FIR against Shreyas Talpade, Alok Nath in fraud case

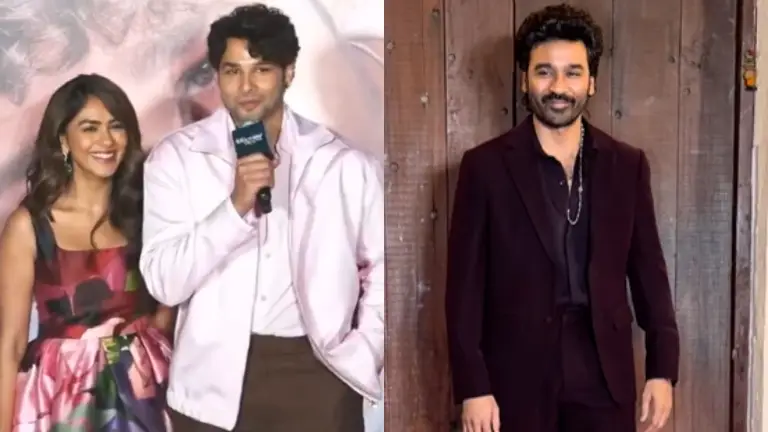

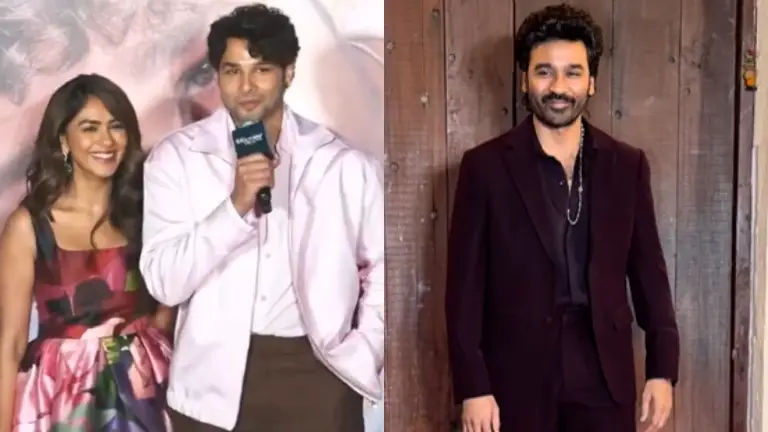

The Central Bureau of Investigation (CBI) has taken a significant step in a multi-crore fraud case by filing an FIR against 46 individuals, including well-known actors Alok Nath and Shreyas Talpade. This development comes after the Uttarakhand High Court ordered the CBI to probe the alleged fraud, as reported by Hindustan Times. The accused have been linked to the Loni Urban Multi-State Credit & Thrift Co-operative Society (LUCC), which is alleged to have defrauded numerous investors.

The LUCC, a cooperative society, was established with the aim of providing financial services to its members. However, it has been accused of collecting large sums of money from investors with promises of high returns, only to disappear with the funds. The alleged scam has left many investors in financial distress, with some even reporting losses of several lakhs of rupees.

Alok Nath, known for his roles in popular TV shows and films, has denied all allegations against him. However, the CBI’s investigation is likely to shed more light on the extent of his involvement in the alleged fraud. Shreyas Talpade, another prominent actor, has also been named in the FIR, although his response to the allegations is not yet known.

The CBI’s decision to file an FIR against the accused individuals is a significant step towards bringing the perpetrators to justice. The investigation is expected to be thorough, with the agency examining all aspects of the alleged fraud, including the role of each accused individual.

The LUCC case is not an isolated incident of fraud in India. In recent years, there have been several instances of cooperative societies and other financial institutions being involved in scams, resulting in significant financial losses for investors. The CBI’s investigation into the LUCC case is, therefore, a crucial step towards preventing such scams in the future.

The Uttarakhand High Court’s order directing the CBI to probe the LUCC case is also a significant development. The court’s intervention highlights the importance of ensuring that such cases are investigated thoroughly and that those responsible are held accountable.

The CBI’s investigation into the LUCC case is likely to be a complex and time-consuming process. The agency will need to examine a large amount of evidence, including financial records and statements from investors. The investigation will also involve analyzing the role of each accused individual and determining the extent of their involvement in the alleged fraud.

In addition to the CBI’s investigation, the LUCC case also raises questions about the regulatory framework governing cooperative societies in India. The fact that the LUCC was able to operate for several years without being detected suggests that there may be gaps in the regulatory framework that need to be addressed.

To prevent such scams in the future, it is essential to strengthen the regulatory framework governing cooperative societies and other financial institutions. This can be achieved by implementing more stringent regulations and ensuring that these institutions are subject to regular audits and inspections.

In conclusion, the CBI’s decision to file an FIR against Alok Nath, Shreyas Talpade, and 44 other individuals in the LUCC case is a significant step towards bringing the perpetrators to justice. The investigation is expected to be thorough, and the outcome will be closely watched by investors and the general public. The LUCC case also highlights the need for a stronger regulatory framework to prevent such scams in the future.

As the investigation into the LUCC case continues, it is essential to remember that the accused individuals are innocent until proven guilty. The CBI’s investigation will provide more clarity on the extent of their involvement in the alleged fraud, and the court will ultimately decide their fate.

The LUCC case is a reminder that fraud can occur in any sector, and it is essential to be vigilant when investing in any financial institution. Investors should always conduct thorough research and due diligence before investing in any scheme, and they should be wary of promises of high returns with little risk.

The CBI’s investigation into the LUCC case is a significant development in the fight against fraud in India. The agency’s efforts to bring the perpetrators to justice will help to prevent such scams in the future and provide a sense of relief to the investors who have been affected.

For more information on this story, please visit: https://www.newsbytesapp.com/news/entertainment/cbi-books-actors-shreyas-talpade-alok-nath-in-fraud-case/story