Mahua Moitra Slams SEBI, Alleges ‘Insider Trading’ in Nazara Deal

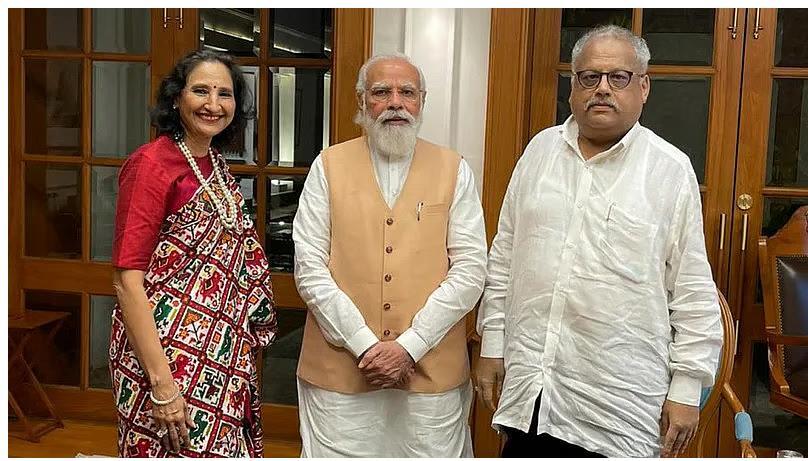

In a shocking development, Trinamool Congress (TMC) MP Mahua Moitra has alleged “insider trading” in the deal involving Nazara Technologies, a leading online gaming firm. The controversy surrounds the sale of 7% stake in Nazara Technologies by Rekha Jhunjhunwala, wife of late investor Rakesh Jhunjhunwala, worth ₹334 crore, just ahead of the introduction of the Online Gaming Bill in Parliament.

Moitra took to social media to express her outrage, saying that if this were to happen in the United States, the Securities and Exchange Commission (SEC) would investigate such deals. However, in India, the Securities and Exchange Board of India (SEBI) seems to be asleep, while “bhakts” (devotees) applaud.

The controversy has raised several questions about the integrity of India’s capital markets and the role of regulatory bodies in preventing insider trading.

Rekha Jhunjhunwala sold her entire stake in Nazara Technologies on June 13, just a day before the Online Gaming Bill was introduced in the Lok Sabha. The bill aims to regulate the online gaming industry, including online rummy and other games. The sale was made through a block deal, where a large quantity of shares is sold simultaneously, often to institutional investors.

Moitra questioned the timing of the sale, saying that it was highly suspicious. “If this were to happen in the US, the SEC would investigate such deals. But in India, SEBI sleeps while bhakts applaud,” she tweeted.

The TMC MP also pointed out that the Online Gaming Bill is significant because it has the potential to impact the fortunes of companies operating in the online gaming space. “The bill is a game-changer for the online gaming industry. It’s not just about regulating the industry, but also about creating a level playing field,” she said.

Moitra’s allegations have sparked a heated debate on social media, with many calling for a thorough investigation into the matter. Some have also questioned the role of SEBI in preventing insider trading.

In a statement, SEBI said that it takes all allegations of insider trading seriously and will investigate the matter. “We have received the complaint and are looking into it. We will take appropriate action if we find any wrongdoing,” a SEBI spokesperson said.

The controversy has also raised questions about the transparency of the Indian capital markets. Many have called for greater disclosure and transparency in share dealings, particularly in cases where large quantities of shares are sold or bought.

The sale of Rekha Jhunjhunwala’s stake in Nazara Technologies has also raised concerns about the impact on the company’s stock price. Nazara Technologies’ shares have been under pressure since the Online Gaming Bill was introduced, and the sale has added to the uncertainty.

The controversy has also highlighted the need for greater regulatory oversight in the Indian capital markets. Many have called for SEBI to take a more proactive role in preventing insider trading and ensuring greater transparency in share dealings.

In conclusion, the controversy surrounding the sale of Rekha Jhunjhunwala’s stake in Nazara Technologies has raised several questions about the integrity of India’s capital markets and the role of regulatory bodies in preventing insider trading. While SEBI has promised to investigate the matter, many have called for greater transparency and accountability in share dealings. As the debate continues, one thing is clear: the Indian capital markets need greater regulatory oversight to prevent such controversies in the future.

Source: