Startup Founder Harassed by Fake GST Officer in UP; Govt Intervenes After His Post

The world of entrepreneurship is never easy, and startup founders often face numerous challenges as they navigate the complexities of building a business from scratch. However, what’s even more daunting is the threat of harassment and fraudulent activities that can disrupt their operations and put their livelihoods at risk. A recent incident in Uttar Pradesh (UP) highlights the importance of vigilance and the need for swift government intervention in such cases.

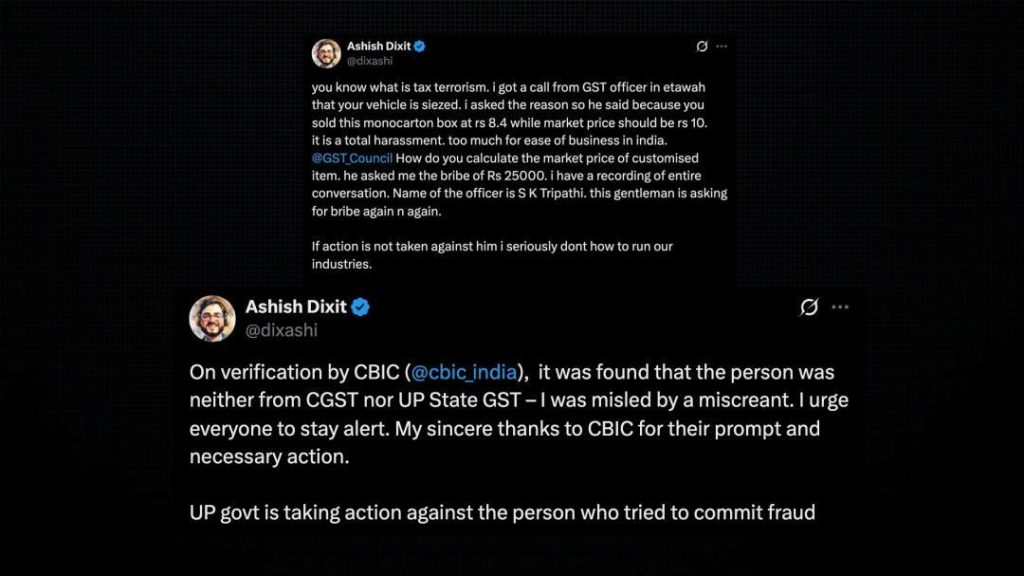

Medhini Products Founder Ashish Dixit recently took to social media to share his harrowing experience of being harassed by a fake GST officer in UP. According to Dixit, the fraudster posed as a Goods and Services Tax (GST) officer and seized his vehicle, citing an alleged discrepancy in the price of mono carton boxes. The impostor demanded a bribe of ₹25,000 to release the vehicle, leaving Dixit and his team shaken.

The incident took place on October 25, when Dixit received a call from a person claiming to be a GST officer from the Central Goods and Services Tax (CGST) department. The caller informed Dixit that there was an issue with the price of mono carton boxes being sold by his company and asked him to meet at a local hotel. Dixit, unaware of the true intentions, arrived at the hotel with his team, only to find the “officer” asking for a bribe to resolve the “issue.”

Dixit, feeling threatened and intimidated, decided to post about the incident on social media, seeking help from his followers and the government. His post quickly went viral, and the government authorities took notice of the incident.

The Central Board of Indirect Taxes and Customs (CBIC) launched an investigation into the matter and found that the person who had harassed Dixit was not a genuine GST officer from either the CGST or UP State Goods and Services Tax (SGST) department. The CBIC also verified the authenticity of Dixit’s claim and ordered the release of his vehicle.

The incident highlights the need for greater awareness and vigilance among entrepreneurs, especially in states like UP, which have seen a surge in instances of GST-related fraud. The government must take concrete steps to prevent such incidents and ensure that genuine taxpayers are not harassed or intimidated by fraudulent activities.

In a statement, the CBIC said, “The CBIC has zero tolerance for such fraudulent activities, and we are committed to ensuring that such incidents do not recur. We urge all taxpayers to remain vigilant and report any suspicious activities to the authorities immediately.”

The government’s swift intervention in this case is a welcome step towards ensuring the protection of entrepreneurs and the credibility of the GST regime. It is essential that the government continues to take proactive measures to prevent such instances and maintain the trust of taxpayers.

Dixit’s experience serves as a stark reminder of the importance of being cautious when dealing with government authorities. Startup founders, in particular, must remain vigilant and report any suspicious activities to the authorities immediately. It is also crucial for the government to provide adequate training to its officials to prevent such incidents from occurring in the first place.

In conclusion, the incident highlights the importance of government intervention and the need for entrepreneurs to be aware of fraudulent activities. The government must continue to take concrete steps to prevent such incidents and maintain the credibility of the GST regime. As Dixit’s story shows, even a simple social media post can lead to swift action and resolution, emphasizing the power of social media in bringing about change.