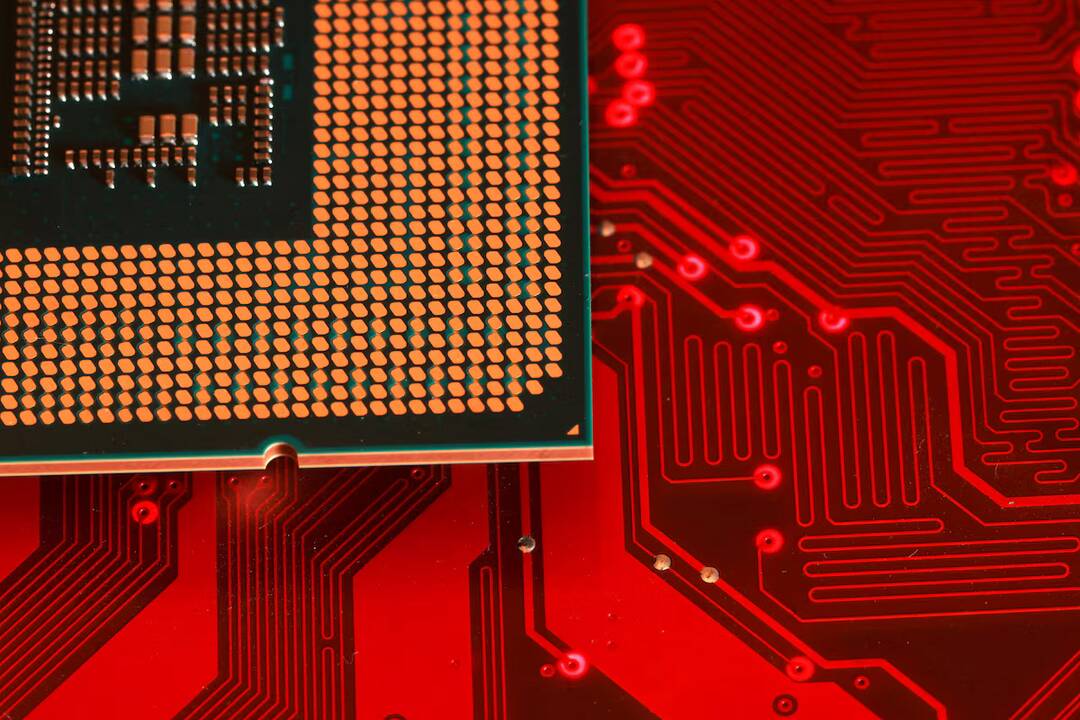

US to impose tariffs on Chinese chip imports in 2027

The United States has announced its decision to delay imposing tariffs on Chinese semiconductor imports until June 2027. This move is seen as a significant development in the ongoing trade tensions between the two nations. According to the US Trade Representative, the decision to impose tariffs is in response to China’s aggressive targeting of the semiconductor industry for dominance, which is deemed “unreasonable and burdens or restricts US commerce and thus is actionable.”

The semiconductor industry is a critical component of the global technology sector, with China and the US being two of the largest players. The US has long been concerned about China’s growing influence in the industry, and the imposition of tariffs is seen as a way to level the playing field and protect American businesses. The US Trade Representative has stated that the tariff rate will be announced at least 30 days in advance, giving businesses and investors time to prepare for the changes.

The decision to impose tariffs on Chinese chip imports is not unexpected, given the current state of trade relations between the two nations. The US has been increasingly critical of China’s trade practices, including its subsidies for domestic industries and its restrictions on foreign investment. The semiconductor industry has been a particular point of contention, with the US accusing China of using unfair trade practices to gain an advantage.

The imposition of tariffs is likely to have significant implications for the global technology sector. Chinese chip manufacturers, such as SMIC and Hua Hong Semiconductor, are likely to be heavily impacted, as they rely heavily on exports to the US market. American companies, such as Intel and Qualcomm, may also be affected, as they have significant supply chains in China and may face increased costs and disruptions as a result of the tariffs.

The delay in imposing tariffs until June 2027 gives businesses and investors time to adjust to the new reality. However, it also creates uncertainty and unpredictability, which can be damaging to the industry as a whole. The US Trade Representative has stated that the tariffs will be imposed in a way that minimizes harm to American businesses and consumers, but the exact details of the tariffs and how they will be implemented remain to be seen.

The semiconductor industry is a complex and globalized sector, with supply chains that span multiple countries and continents. The imposition of tariffs on Chinese chip imports is likely to have far-reaching implications, not just for the US and China, but for the entire industry. As the situation continues to evolve, it will be important to monitor the developments and assess the potential impact on businesses and investors.

In recent years, the US has been taking a more aggressive stance on trade, with a focus on protecting American businesses and workers. The imposition of tariffs on Chinese chip imports is just the latest example of this trend. While the move is likely to be welcomed by some American businesses, it is also likely to be opposed by others, who may see it as a threat to their supply chains and competitiveness.

The US-China trade relationship is complex and multifaceted, with both nations having significant interests and investments in each other’s economies. The imposition of tariffs on Chinese chip imports is a significant development, but it is just one part of a larger story. As the situation continues to evolve, it will be important to consider the broader context and the potential implications for the global economy.

In conclusion, the US decision to impose tariffs on Chinese chip imports in 2027 is a significant development in the ongoing trade tensions between the two nations. The move is seen as a way to protect American businesses and level the playing field, but it is also likely to have significant implications for the global technology sector. As the situation continues to evolve, it will be important to monitor the developments and assess the potential impact on businesses and investors.

For more information on this topic, please visit: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/

The US Trade Representative’s decision to impose tariffs on Chinese chip imports is a significant development, and it will be important to continue monitoring the situation as it evolves. The implications of this move will be far-reaching, and it will be important to consider the potential impact on businesses and investors. As the global economy continues to evolve, it will be important to stay informed about the latest developments and trends.

The semiconductor industry is a critical component of the global technology sector, and the imposition of tariffs on Chinese chip imports is likely to have significant implications for the industry as a whole. The US and China are two of the largest players in the industry, and the trade tensions between the two nations are likely to continue to be a major factor in the industry’s development.

As the situation continues to evolve, it will be important to consider the potential implications of the tariffs on Chinese chip imports. The US Trade Representative has stated that the tariffs will be imposed in a way that minimizes harm to American businesses and consumers, but the exact details of the tariffs and how they will be implemented remain to be seen.

In the coming months and years, it will be important to monitor the developments in the semiconductor industry and the US-China trade relationship. The imposition of tariffs on Chinese chip imports is a significant development, but it is just one part of a larger story. As the situation continues to evolve, it will be important to consider the broader context and the potential implications for the global economy.

For the latest information on this topic, please visit: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/

News Source: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/