US to impose tariffs on Chinese chip imports in 2027

The United States has announced its decision to delay imposing tariffs on Chinese semiconductor imports until June 2027. This move is seen as a significant development in the ongoing trade tensions between the two nations. According to a statement released by the US Trade Representative, the decision to impose tariffs is in response to China’s efforts to dominate the semiconductor industry, which is deemed “unreasonable and burdens or restricts US commerce and thus is actionable.”

The US Trade Representative’s statement highlights the concerns of the US government regarding China’s aggressive pursuit of dominance in the semiconductor sector. The US has long been a leader in the global semiconductor industry, and China’s efforts to catch up have been viewed with skepticism by American policymakers. The imposition of tariffs is seen as a measure to protect the interests of US companies and to prevent China from gaining an unfair advantage in the industry.

The tariff rate on Chinese chip imports will be announced at least 30 days in advance, according to the US Trade Representative. This will give companies and investors time to adjust to the new trade landscape and make necessary arrangements to mitigate the impact of the tariffs. The delay in imposing tariffs until June 2027 is likely to provide a temporary reprieve to Chinese chipmakers, but it also serves as a warning to them to reassess their business strategies and comply with US trade regulations.

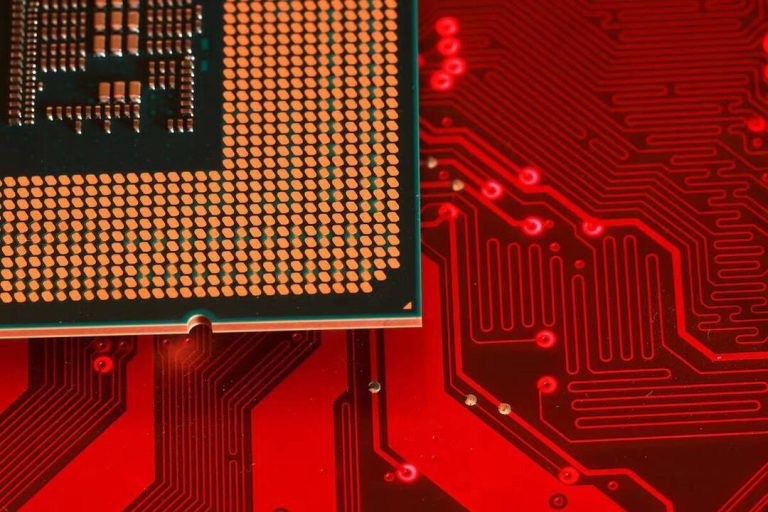

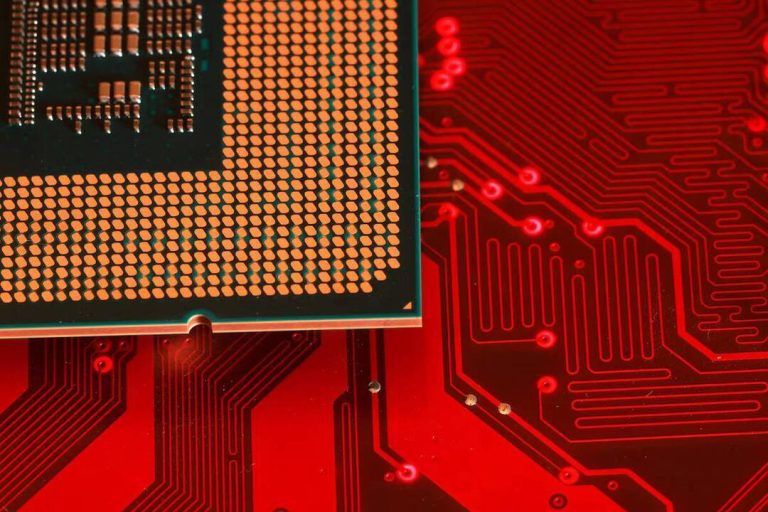

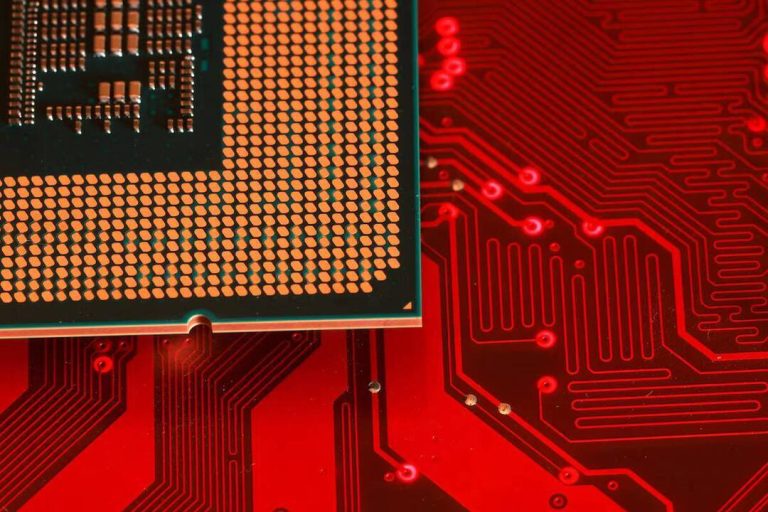

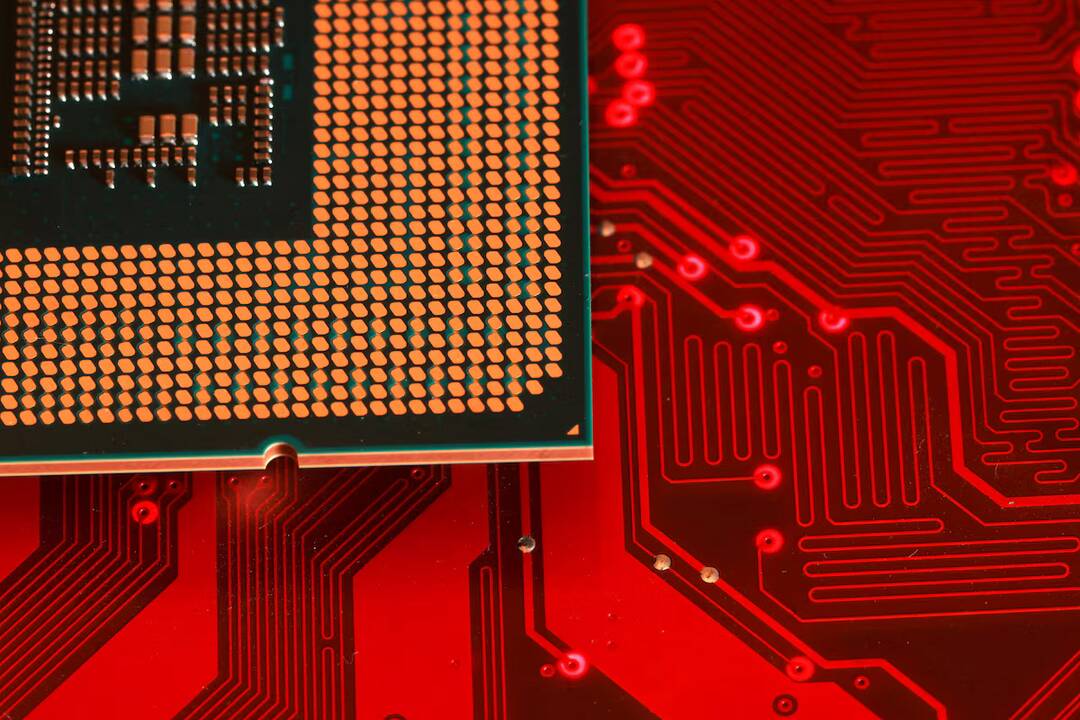

The US semiconductor industry is a critical component of the country’s economy, with major companies like Intel, Qualcomm, and Micron Technology playing a significant role in the global chip market. The industry is also a key driver of innovation, with semiconductors being used in a wide range of applications, from consumer electronics to automotive and aerospace systems. The US government’s decision to impose tariffs on Chinese chip imports is seen as a measure to protect the competitiveness of US companies and to prevent China from undermining the global semiconductor supply chain.

China’s efforts to dominate the semiconductor industry are part of its broader strategy to become a technological superpower. The Chinese government has invested heavily in the sector, providing subsidies and support to domestic chipmakers and encouraging foreign companies to set up operations in the country. However, the US and other Western nations have expressed concerns about China’s trade practices, including its use of state-backed funding and intellectual property theft.

The imposition of tariffs on Chinese chip imports is likely to have significant implications for the global semiconductor industry. Companies that rely on Chinese chipmakers for their supply chain may need to diversify their sourcing or face increased costs due to the tariffs. The move may also lead to a rise in chip prices, which could have a ripple effect on the broader technology industry.

In recent years, the US and China have been engaged in a trade war, with both countries imposing tariffs on each other’s goods. The trade tensions have had a significant impact on the global economy, with companies and investors facing uncertainty and volatility. The decision to impose tariffs on Chinese chip imports is seen as a further escalation of the trade war, and it remains to be seen how China will respond to the move.

The US Trade Representative’s statement on the imposition of tariffs on Chinese chip imports highlights the complexities of the global trade landscape. The move is seen as a measure to protect US interests and to prevent China from gaining an unfair advantage in the semiconductor industry. However, it also raises questions about the potential impact on the global economy and the consequences of escalating trade tensions between the US and China.

In conclusion, the US decision to impose tariffs on Chinese chip imports in 2027 is a significant development in the ongoing trade tensions between the two nations. The move is seen as a measure to protect US interests and to prevent China from dominating the semiconductor industry. However, it also raises questions about the potential impact on the global economy and the consequences of escalating trade tensions. As the situation continues to unfold, companies and investors will need to stay vigilant and adapt to the changing trade landscape.

News Source: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/