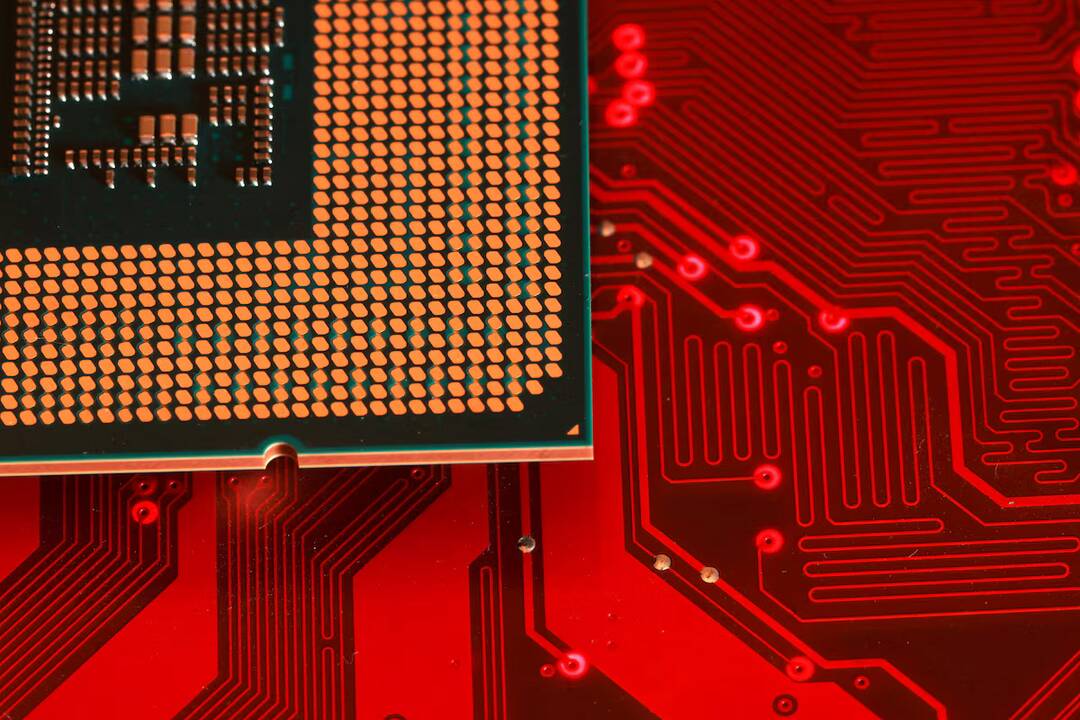

US to impose tariffs on Chinese chip imports in 2027

The United States has announced its decision to delay imposing tariffs on Chinese semiconductor imports until June 2027. This move is part of a broader effort to address China’s growing dominance in the global semiconductor industry, which has been deemed “unreasonable” and a burden to US commerce. According to the US Trade Representative, China’s targeting of the semiconductor industry for dominance is a clear example of unfair trade practices that restrict or burden US commerce, making it actionable under US trade laws.

The US Trade Representative’s statement highlights the concerns surrounding China’s aggressive expansion into the semiconductor industry, which has been fueled by significant investments and government support. The Chinese government has made no secret of its ambitions to become a leading player in the global semiconductor market, with a focus on developing cutting-edge technologies such as 5G, artificial intelligence, and renewable energy. However, this rapid expansion has raised concerns among US policymakers and industry leaders, who argue that China’s practices are unfair and undermine the competitiveness of US-based semiconductor companies.

The decision to impose tariffs on Chinese chip imports is a significant development in the ongoing trade tensions between the US and China. The tariffs are intended to level the playing field and provide a more competitive environment for US-based semiconductor companies. The US Trade Representative has stated that the tariff rate will be announced at least 30 days in advance, providing affected companies with sufficient notice to adjust their business strategies.

The implications of this decision are far-reaching and will likely have significant impacts on the global semiconductor industry. Chinese companies such as SMIC, Hua Hong Semiconductor, and CXMT will likely be among the hardest hit, as they rely heavily on exports to the US market. The tariffs will also affect US-based companies that rely on Chinese-made semiconductors, such as Apple, Intel, and Qualcomm, which may need to adjust their supply chains to mitigate the impact of the tariffs.

The delay in imposing tariffs until June 2027 provides a temporary reprieve for affected companies, allowing them to adjust their business strategies and explore alternative sourcing options. However, the long-term implications of this decision are likely to be significant, with potential consequences for the global semiconductor industry, including increased costs, reduced competitiveness, and potential disruptions to supply chains.

The US-China trade tensions have been escalating in recent years, with both countries imposing tariffs on each other’s goods. The semiconductor industry has been a key area of focus, with the US seeking to protect its domestic industry and prevent China from gaining an unfair advantage. The imposition of tariffs on Chinese chip imports is a significant escalation of these tensions and will likely have far-reaching consequences for the global economy.

In conclusion, the US decision to impose tariffs on Chinese semiconductor imports in 2027 is a significant development in the ongoing trade tensions between the two countries. The move is intended to address China’s unfair trade practices and level the playing field for US-based semiconductor companies. While the delay in imposing tariffs provides a temporary reprieve for affected companies, the long-term implications of this decision are likely to be significant, with potential consequences for the global semiconductor industry and the broader economy.

As the situation continues to evolve, it will be important to monitor developments closely and assess the potential impacts on the global economy. The US Trade Representative’s decision to impose tariffs on Chinese chip imports is a clear indication of the ongoing tensions between the two countries and the willingness of the US to take action to protect its domestic industries.

The global semiconductor industry is a complex and highly interconnected ecosystem, with companies relying on each other for components, manufacturing, and design services. The imposition of tariffs on Chinese chip imports will likely have significant ripple effects throughout the industry, with potential consequences for companies, consumers, and the broader economy.

As we look to the future, it will be important to consider the potential implications of this decision and the potential consequences for the global semiconductor industry. The US-China trade tensions are likely to continue, with ongoing negotiations and potential further escalation. The imposition of tariffs on Chinese chip imports is a significant development in this ongoing saga and will likely have far-reaching consequences for the global economy.

News Source: https://www.reuters.com/world/china/us-impose-tariffs-chips-china-2025-12-23/