RRP Semiconductors, whose stocks rose 74,000% in 627 days, never manufactured semiconductors

In a shocking revelation, RRP Semiconductors, a Maharashtra-based firm, has been found to have never manufactured semiconductors, despite its stock prices skyrocketing by a staggering 74,000% in just 627 days, or approximately 20 months. This unprecedented rise in stock value has raised eyebrows among investors and regulatory bodies, prompting an investigation into the company’s activities.

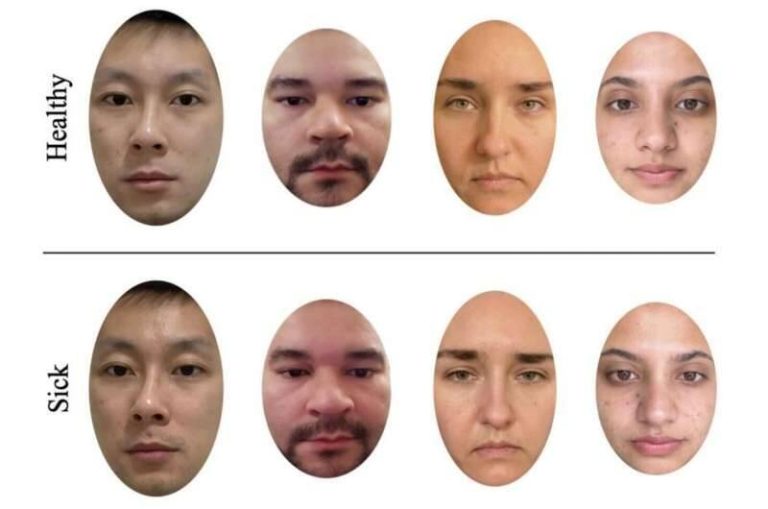

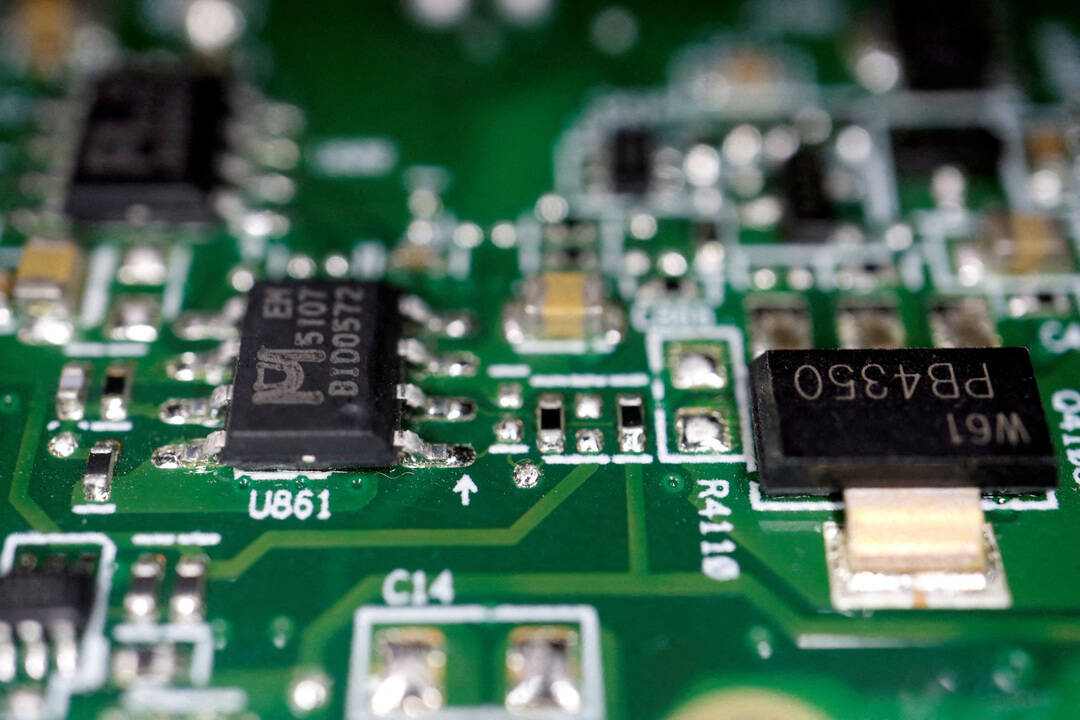

To put this into perspective, a 74,000% increase in stock value is an unusually high return on investment, especially considering the company’s claims of being involved in the semiconductor industry. The semiconductor industry is a highly competitive and technologically advanced field, requiring significant investments in research and development, manufacturing, and quality control. For a company to achieve such a high return without actually manufacturing semiconductors is, to say the least, suspicious.

As a result of this unusual price movement, the company’s shares were halted for trading, and the firm was put under surveillance measures by regulatory authorities. This move was intended to prevent further price manipulation and to protect investors from potential losses. In a regulatory filing published on November 3, RRP Semiconductors accepted that it was “yet to start any sort of semiconductor manufacturing.” This admission has left many wondering how the company’s stock prices managed to rise so dramatically without any actual production or revenue generation.

The news of RRP Semiconductors’ lack of manufacturing activities has sparked a debate about the effectiveness of regulatory measures in preventing market manipulation. The fact that a company with no actual operations in the semiconductor industry could see its stock prices rise so sharply raises concerns about the vulnerability of the market to price manipulation and insider trading.

Furthermore, the case of RRP Semiconductors highlights the importance of due diligence and thorough research before investing in any company. Investors should always verify the claims made by companies and look for evidence of actual operations and revenue generation before putting their money into the stock market. This is especially true for companies that claim to be involved in high-tech industries like semiconductors, where the barriers to entry are typically high, and the competition is fierce.

The story of RRP Semiconductors also serves as a reminder of the risks associated with investing in the stock market. While the potential for high returns is always attractive, investors should be aware of the potential for significant losses if the company’s stock prices were to plummet. In this case, the halt in trading and regulatory scrutiny have likely prevented further losses for investors, but it is still unclear how the company’s stock prices will perform in the long term.

In conclusion, the case of RRP Semiconductors is a stark reminder of the importance of regulatory oversight and investor diligence in the stock market. The fact that a company with no actual manufacturing operations could see its stock prices rise so sharply is a clear indication of the need for stricter regulations and more effective enforcement mechanisms. As investors, it is essential to be cautious and to do our due diligence before investing in any company, especially those that claim to be involved in high-tech industries.

The story of RRP Semiconductors will likely serve as a cautionary tale for investors and regulatory bodies alike, highlighting the need for greater transparency and accountability in the stock market. As the investigation into the company’s activities continues, it will be interesting to see how the regulatory authorities respond to this unusual case and what measures they will take to prevent similar incidents in the future.

News Source: https://www.news18.com/amp/viral/stocks-of-indian-company-with-just-2-workers-see-55000-surge-aa-ws-l-9782647.html